11 Best Travel Insurance Companies for digital nomads reviewed

Looking for a reputable travel insurance company to use when traveling abroad? Look no further than the top-rated travel insurance companies. These companies have years of experience insuring travelers and offer various options to fit every budget.

Check the 11 best travel insurance companies to use when traveling abroad. However, some key factors to consider when choosing a travel insurance company include its history of customer satisfaction, what types of coverage are offered, and how much money is required to purchase the policy.

Safety Wing

Nomad Insurance by Safety Wing was created specifically with the digital nomad in mind. With5 their basic plans starting at only $42 per month and covering both medical and travel, it’s difficult to find a more inclusive plan in this price range. They also now offer COVID-19 coverage. This is the best policy insurance we found.

World Nomads

World Nomads offers a variety of travel insurance products, including single trip, multi-trip, evacuation, and medical insurance. The company also offers a 24/7 customer support team and a money-back guarantee. World Nomads Travel Insurance is a company that specializes in travel insurance for nomads.

Travelex

Quality insurance company With decades of experience under its belt, Travelex Insurance offers a wide range of products and services to meet the needs of any individual or business. From car insurance to travel insurance, trip cost insurance, rental car coverage, Travelex Insurance has you covered.

When traveling abroad, it is always important to have travel insurance in an emergency. There are many different travel insurance companies to choose from, so it can be hard to decide which one is the best for you. Here are some of the best travel insurance companies to use when traveling abroad.

11 best travel insurance companies for Digital Nomads when traveling abroad Reviewed and Ranked

Nomad Insurance (By Safety Wing)

Nomad Insurance was created specifically with the digital nomad in mind. With their basic plans starting at only $42 per month and covering both medical and travel, it’s difficult to find a more inclusive plan in this price range. They also now offer COVID-19 coverage.

One aspect that sets the SafetyWing travel insurance plan apart is that you can sign up during your journey towards your destination. So, you can sign up and immediately have coverage even if you’re in the middle of a trip but not after you’re in the hospital. Another thing is that they offer both travel and medical health insurance for digital nomads.

Their health insurance plan for remote workers and digital nomads offers full health coverage in your home country while visiting and wherever you travel abroad. It includes many health-related issues, but not travel. This plan is for long-term travelers, and the estimated rate for those ages 18-39 is around $153/month.

If you’re looking for coverage for medical and travel expenses, Nomad Insurance for nomads is one of the best options. This one can also be purchased for short or long-term use. It covers medical care, travel delay, lost luggage, natural disasters, and more.

Users Experience

The monthly estimate for this plan starts around $42, but this can vary depending on your age and where you plan to travel to and for how long.

Overall, if you’re looking for full-coverage health insurance for digital nomads or you want a plan that covers travel and health expenses, Nomad Insurance is a great option for your travel needs.

Their new policies include coverage for COVID-19, it’s a very well-rounded plan covering most medical or travel issues you could encounter at a more affordable rate than many other plans on the market today.

Pros

- Offers affordable, quality digital nomad insurance in over 175 countries

- You don’t need permanent residency in any country to get insurance

- You don’t have to pay in full all at once

- You can choose your own private doctors or hospital

- You can make monthly payments

- Policy includes 2 children under the age of 10 with accompanying couple

- Coverage covers Covid-19 cases

Cons

- It is common to encounter difficulties making claims

- An international licence is required to be covered under motorcycle accidents

- Coverage limits max out at $250,000

- Activites considered risky may not be covered

Travelex Insurance

Looking for a quality insurance company? Travelex Insurance Company is a global insurance provider operating in over 100+ countries. With decades of experience under its belt, Travelex Insurance offers a wide range of products and services to meet the needs of any individual or business. From car insurance to travel insurance, trip cost insurance, rental car coverage, Travelex Insurance has you covered.

Travelex Insurance offers travelers the added peace of mind of knowing they are fully protected in a trip-related emergency. Travelex insurance is a great way to ensure that your travel dreams come true with coverage for medical expenses, lost baggage, baggage delay coverage, car rental insurance and more.

Users Experience

Travelex Insurance users have had positive experiences with the company. Travelex has an excellent customer service department and provides many policies. Travelex is also known for its fast processing of claims.

Many people are unaware that Travelex offers comprehensive travel medical insurance coverage for its customers. In the event of a medical emergency, Travelex will provide assistance and support to its customers. This is especially helpful for people traveling outside their home country or with limited medical options. Travelex provides good medical coverage for trip interruption coverage.

Travelex will cover your costs for return travel or hotel accommodation while receiving treatment if you cannot continue your trip due to a medical emergency. This policy is beneficial for travelers and insurance companies, as it helps minimize inconvenience and disruption in people’s lives.

Insurance Plan

- Basic Insurance Plan $377

- Select Insurance Plan $333

- Max Insurance Plan $895

Pros & Cons

PROs

- Epidemic coverage endorsement

- medical evacuation coverage

- A business-oriented annual plan that is designed for travel

- Hotline for multilingual assistance 24 hours a day

Cons

- Medical coverage is not as high.

- There is no “cancel for any reason” benefit.

Allianz Travel Insurance

If you are planning a trip and want to be sure that you and your family are taken care of if something happens on your trip, then travel insurance is essential. Allianz Travel Insurance offers a variety of plans with different levels of coverage, so you can find one that is right for you.

Allianz Travel Insurance is a great option for those looking for travel insurance providers to purchase travel insurance coverage. Allianz offers a variety of benefits, including Trip cancellation, emergency medical and repatriation assistance. The company also has a great reputation, evidenced by its many positive online reviews. Overall, Allianz is a great choice for those looking for travel insurance coverage.

When it comes to emergency medical coverage, travel insurance can help cover the costs associated with any medical bills that may arise while you are away from home. Whether you are traveling for business or pleasure, get insurance covering all of your bases.

Users Experience

Allianz Travel Insurance users have reported overwhelmingly positive experiences with the product. One user said: “I highly recommend Allianz travel insurance – their easy-to-use website and helpful customer service made the process of purchasing and registering very simple.” Another commented: “I was impressed with how well Allianz Travel Insurance covered preexisting conditions on my single trip policy. The trip cost details were also excellent, I had a clear understanding what was covered and what wasn’t.

The Allianz Travel Insurance company is one of the most popular choices for travel insurance providers. They offer a variety of policies and cover a wide range of activities and destinations. Their customer service is excellent, and they are known for their quick response times and you can cancel for any reason. Allianz should be at the top of your list if you’re looking for a reliable and affordable travel insurance provider.

Insurance Plan

- Trip cancellation: Up to $100,000

- Trip interruption: Up to $150,000

- Travel delay: Up to $1,600

- Baggage coverage: Up to $2,000

- Medical: $50,000

Pros & Cons

Pros

- Plans for single or annual trips are available.

- Many types of insurance can meet different requirements

- Make sure you and your household are protected throughout the year, even if you’re not on a trip with your family

- Lodging expense benefit

- Comprehensive coverage limits

- Exchange and trip saver coverage are also included

- The insurance covers a child under 17

- Encourages travelers to visit Cuba when they traveler has additional documents.

Cons

- Does not cover long travel durations

- Certain annual plans have limits per trip, while other plans have annual limits.

- The limit of emergency medical transportation insurance is $250,000.

- The high cost of premiums.

- The majority of add-ons aren’t available on the basic plan.

Generali Global Assistance

Generali Global Assistance (GGA) is a private assistance organization focusing on disaster relief. The organization has been operational since 1984 and assists in over 70 countries. Generali Global Assistance is a global travel insurance group that offers emergency medical evacuation coverage for business travelers.

Generali Global Assistance has been designed to provide timely and comprehensive support to people affected by natural disasters. The company offers a range of services, including trip cost, emergency medical, preexisting medical conditions, insurance covering baggage and personal effects, and assistance with applications for aid and repatriation.

Trip costs are the most common reason for travel cancellations, and Generali provides coverage for all types of trips, including business trips, vacations, and cruises. However, most travel insurance policies cover trip costs, including airfare, hotel accommodations, and transportation expenses. If something goes wrong while you’re away, your insurer will help to get you back home safely.

Users Experience

Generali Global Assistance users have much to say about their experience with the company. They appreciate the timely response time and the ability to resolve issues quickly. They also appreciate the flexibility of Generali Global Assistance’s policies and the availability of bilingual support. Users feel that Generali Global Assistance is a reliable, easy-to-use resource.

Today, many people take advantage of travel health insurance and medical benefits when traveling. Generali Global Assistance can benefit users, making it easy for users to access these services. By partnering with several carriers, Generali Global Assistance offers a variety of options for travelers including trip cancellation coverage.

Generali Global Assistance user’s experience is a new online resource that provides insights into how Generali Global Assistance is being used by its customers. The website includes case studies and testimonials from people who have used the service to resolve various issues.

Insurance Plan

- Standard Insurance Plan $298.52

- Preferred Insurance Plan $346.28

- PremiumInsurance Plan $398

Pros & Cons

PROS

- Coverage for sporting equipment is included in the mid-tier plan of the company.

- Emergency medical coverage: $100,000 (accident and illness)

- Make sure to buy more items while you travel.

- 24/7-hour emergency assistance (Generali Global Assistance)

CONS

- There is no CFAR option available.

- Trip Cancellation/Interruption coverage low compared to other providers

- Preexisting conditions are available only on the Premium plan.

WorldTrips

WorldTrips Insurance offers many benefits, including trip interruption coverage, medical expenses, baggage coverage, rental car coverage etc. The policy also provides 24-hour customer support in case of any issues or questions during your trip. To learn more about this great travel insurance policy.

Check out WorldTrips! This site offers unique and affordable trips to places all over the world. You can find trip options for any budget, and their travel insurance cover ensures that you are covered if something goes wrong on your trip. If you’re looking to explore a new place without spending a fortune, WorldTrips Into is the perfect site, ask about their annual travel insurance plan!

Users Experience

WorldTrips users report that the service is easy to use and provides good insurance customer service. The company offers a variety of purchase travel insurance options, as well as a variety of discounts and promotions. Users say that the service is reliable and affordable.

Customers of the WorldTrips were pleased with the ease of use and the variety of coverage options. The service was reliable and gave customers peace of mind while traveling. Overall, customers found the experience positive and would recommend it to others.

WorldTrips to cover travel medical insurance can be a lifesaver. After all, what good is a trip if you can’t enjoy it? Many people turn to the company for help when planning their travels.

Other travel insurance options might be available such as car rental collision insurance, baggage delay coverage, trip interruption coverage, and comprehensive coverage policies.

Insurance Plan

- $500 in coverage for missed connections

- $500,000 for emergency medical evacuation coverage

- $25,000 for medical coverage limits

- $1000 for trip delays

- 100% in trip cancellation coverage limits

- 150% for trip interruption coverage limits

Pros & Cons

PROS

- 24-Hour Emergency Assistance Services.

- Medical expenses are not covered out of pocket.

- Available car rental damage insurance add-on.

CONS

- Preexisting condition coverage is only available with the Premium plan.

- Costs for premiums are very high.

- Cancel for any reason; only available to Premium plans.

Seven Corners

Seven Corners travel insurance companies are available to help protect you while traveling. This company has years of experience insuring people who have to travel for work or pleasure. It can cover medical expenses, accidents, lost luggage, and more. Compare the different policies and choose the one that is best for you.

Seven Corners travel insurance company is a great option for people who are looking for affordable, comprehensive trip cancellation and emergency evacuation coverage. The company has a variety of policies to choose from, and its rates are very reasonable. In addition, the company has a great customer service team available 24/7 to help you with any questions or concerns.

Things travel insurance cover are like baggage delay coverage, medical evacuation, travel medical coverage, and pre existing conditions. Most travel insurance companies list these items as additional options to a comprehensive coverage policy.

Users Experience

Seven Corners is a travel insurance plan that promises to provide travelers with coverage for any unforeseen event while on their trip. The company offers a variety of benefits, including coverage for medical expenses, evacuation costs, and lost luggage. Seven Corners also offers a 24/7 customer service hotline and free supplemental insurance for trip cancellations due to strikes or natural disasters.

Travelers looking for an affordable and reliable travel insurance plan should consider Seven Corners. This company offers a variety of plans that are tailored to the needs of different travelers. In addition to single trip plans, Seven Corners also offers family and group travel insurance. This type of coverage can help protect families when they are traveling together and groups of people traveling together for a specific purpose.

Insurance Plan

- Trip cancellation: Up to $30,000

- Trip interruption: Up to 150% of the cost

- Travel delay: Up to $1,500

- Baggage: Up to $2,500

- Medical: Up to $250,000

Pros & Cons

Pros

- Five days of coverage up to 364 days

- Coverage extension is allowed

- CoVID-19 coverage is available.

- The website includes examples of scenarios to help users can have a better idea of how coverage is implemented.

- cancel for any reason

Cons

- Activities that pose a risk are not covered under the coverage (add-on only)

- Not accessible for M.D., WA, NY, SD, or C.O. residents.

IMG Travel Insurance

If you’re planning on traveling this year, make sure you have IMG Travel Insurance. IMG is a well-known and trusted travel insurance provider and has years of experience to draw upon when it comes to insuring travelers. This IMG Travel Insurance Overview will give you an overview of the company, its services, and how it can benefit you when traveling.

IMG Travel Insurance is a comprehensive travel insurance policy that covers a range of activities, including traveling. It is provided by IMG Worldwide Insurance Group, one of the world’s largest insurance companies. Some policies are specific to different types of travel—such as airfare or car rental insurance. Other policies may cover various activities, such as vacations, cruises, and overseas travel.

Users Experience

IMG Travel Insurance is a popular travel insurance policy that offers consumers a variety of features and user experiences. Travel insurance is one of the most important things for anyone who plans on traveling. Even though you may feel like you are taking every precaution, accidents can result in serious injury or even death. That’s why it’s important to find a policy that meets your needs, including coverage for medical expenses, loss of income, and more.

IMG Travel Insurance is a great way to get benefits while traveling. IMG Travel Insurance offers coverage for medical expenses, theft, loss and damage, cancellations and delay, and more. Plus, it has a variety of discounts and offers available, so you can find the best deal for you. So why not give IMG Travel Insurance a try? You might just find that you’re glad you did!

Insurance Plan

- 150% of the trip’s cost for interruption coverage

- $50,000 per person for trip cancellation coverage

- $500 for travel delay coverage

- $500,000 for emergency medical evacuation

Pros & Cons

Pros

- It is easy to look up benefits and prices

- You can choose plans from top-rated firms

- There are more than 75,000 user reviews.

- They guarantee total security

- They will quickly confirm coverage by an email

Cons

- There are no significant cons to be found.

- No rental car coverage is available.

HTH Travel Insurance

HTH Travel Insurance is a leading provider of travel insurance products and services. Travel insurance is a good way to protect yourself from unforeseen circumstances while you are away. Travel insurance is important because it can help cover expenses like medical costs, lost luggage, and more. There are many different travel insurance policies available, so it is important to compare prices and features before making a purchase.

HTH Travel Insurance company offers a variety of policies, including those for international travel and cruise travel. Additionally, HTH Travel Insurance is one of the few companies that insure all types of trips, including destination weddings. Whether you’re planning a short vacation or a long trip, HTH Travel Insurance can provide you with the coverage you need.

Users Experience

HTH Travel Insurance can provide coverage if something goes wrong while you’re away. It can cover things like medical expenses, lost wages, and more. This type of insurance is essential for anyone who frequently travels, as it can help protect you from expensive, unexpected costs. People who travel often know the importance of taking proper travel insurance. However, many people overlook the benefits that insurance can provide.

HTH Travel Insurance is a great option for users because it covers various activities, including travel over the border to Canada. No matter where you go, there are always dangers that can arise. That’s why it’s essential to have travel insurance in place. HTH Travel Insurance is a great option for users who want peace of mind while away from home.

Insurance Plan

Travel Basic Travel Basic is an affordable plan for those on a tight budget, digital nomads, Missionary trips, backpackers, students, or small groups. The plans cover interruptions and cancellations for 100% of the trip’s cost and up to $2,000 in case of delay in travel or missing connections.

Pros & Cons

Pros

- You can easily submit a claim through their official website

- A user-friendly website

- They offer advice regarding health, safety travel, and family travel.

- Excellent customer service assistance

- They provide emergency Assistance

- No reason to cancel or upgrade is available

- They have a highly developed phone application that works with both Android and iOS

Cons

- There aren’t as many customer reviews as the two companies before

- There were no other cons of any significance discovered.

World Nomads Travel Insurance

World Nomads travel insurance is a policy that offers international travelers the peace of mind they need while traveling. World Nomads offers a variety of travel insurance products, including single trip, multi-trip, evacuation, and medical insurance. The company also offers a 24/7 customer support team and a money-back guarantee. World Nomads Travel Insurance is a company that specializes in travel insurance for nomads.

World Nomads Travel Insurance is a travel insurance company that provides coverage for nomadic travelers. World Nomads offers a variety of travel insurance products and services, including trip cancellation, medical coverage, and lost luggage coverage. The company has a reputation for being affordable and responsive to customer needs.

Users Experience

World Nomads Travel Insurance users are reporting that the company is doing a great job at assisting in case of an emergency. The company has responded quickly to any requests for help and has been able to provide coverage for a lot of different situations. Overall, users are very satisfied with the service World Nomads provides.

World Nomads travel insurance users have experienced the policy’s benefits differently. Some have found it to be an affordable way to cover their travel needs, while others have used it as a safety net in an emergency. Regardless of its use, all users agree that it is an important part of their travel preparations.

Insurance Plan

In terms of costs, it depends on the plan. If, for instance, you choose emergency medical insurance that offers coverage that is as high as $300,000. Typically, you’ll need to choose among those plans: the Standard Plan and Explorer Plan. The former plan is suited for short trips, while the latter comes with high-end features like $10,000 trip insurance and $100,000 in a medical emergency.

Pros & Cons

Pros

- Donate money to charities.

- They donated more than $3 million to charity and financed over 150 different development initiatives.

- They offer reasonable rates for their plans.

- They have a variety of plans available.

- You can easily download all their useful tools.

Cons

- They don’t offer an application for mobile phones.

- There were no other major cons identified.

We will receive a fee when you get a quote from World Nomads using this link. Financial Nomads does not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

GeoBlue

GeoBlue Travel Insurance is a travel insurance company that provides coverage for worldwide travel. GeoBlue offers a variety of travel insurance options, including standard travel insurance, extended travel insurance, and trip cancellation insurance. GeoBlue Travel Insurance might be the perfect solution for you. This company offers a variety of travel insurance plans that can protect you from various potential accidents, illnesses, and more. In addition to providing coverage while you’re traveling, GeoBlue also provides helpful tips and advice on how to make your trip as safe and hassle-free as possible.

Users Experience

GeoBlue Insurance is a company that provides online insurance services. The company surveyed its users to find out what they liked and didn’t like about the service. Based on this information, GeoBlue changed the service to make it more user-friendly. The survey results were released in a report titled “User Experience: Going Beyond Traditional Surveys.” The report found that users appreciated the ability to review their policies online and make changes without calling customer service.

GeoBlue is a new insurance company that is gaining popularity among its users. The company provides various insurance products, including car, home, and pet insurance. GeoBlue’s user experience is praised for its ease of use and the many features. GeoBlue is also noted for its low rates and its commitment to customer service.

Insurance Plan

For single trip protection, GeoBlue offers trip cancelation of up to $10,000 under its Essentials Plan and $30,000 in its Prime Plan. The plan also offers a one-year travel insurance plan at $59 annually to cover medical costs, medical evacuation, lost luggage, and assistance with travel.

Pros & Cons

Pros

- Medical insurance coverage for traveling

- Offers medical insurance when other expenses for travel are covered

- Different policies permit you to meet a variety of needs and preexisting issues

Cons

- The primary purpose of this policy is to cover medical expenses

- Additional medical coverage for primary needs

InsureMyTrip

Traveling can be a fun and exciting experience, but it can also be risky. That’s why it’s important to have travel insurance in place. InsureMyTrip is one of the leading travel insurance providers, and they offer a variety of policies that cover a wide range of risks. Their company history is rooted in providing quality insurance products to people worldwide.

Travel insurance is a necessary purchase for anyone who plans on traveling. It protects you financially if something happens while you’re away from home. Several types of travel insurance are available, each with its benefits and drawbacks. InsureMyTrip is one of the leading travel insurance providers. They offer various coverage options, including trip cancellation and interruption, medical expenses, baggage theft, and more.

Users Experience

InsureMyTrip is a new insurance company allowing users to purchase travel plans insurance. The company was founded by two entrepreneurs who believe there is a need for an affordable and easy-to-use insurance option for travelers.

It provides travelers with affordable and convenient insurance options. To test the company, we traveled to six different destinations in three different countries. The trip cost includes the travel medical insurance coverage. Our experiences with InsureMyTrip were positive overall – the customer service was responsive and helpful, and the prices were very reasonable. We would recommend InsureMyTrip to any traveler planning a trip.

Insorence Plan

- Trip cancellation insurance the entire amount of cost of the trip

- Trip interruption insurance that covers up to 150% of amount of the

- Coverage for travel delays as high as $1000 (maximum at $125 daily)

- Medical evacuation insurance for emergencies as high as $500,000

- Change up to $150 fee reimbursement

Pros & Cons

Pros

- Donations can be made to charities.

- They offer affordable prices to purchase their plans

- They have a variety of plans available.

- It is easy to download all their useful tools

Cons

- They do not offer an app for mobile devices.

- The other major cons could not be discovered.

- Does not cover adventure sports

Trawick International

Trawick International is a Travel Insurance company that provides travel insurance for people traveling outside their home country. Trawick International Travel Insurance is a Canadian company offering international travel insurance.

Trawick International Travel Insurance is a British insurance company that provides travel insurance for people traveling outside of the country. The company was founded in 1987 and has since grown to become one of the leading providers of travel insurance products in the U.K. Trawick International Travel Insurance offers a range of travel insurance products, including trip cancellation and interruption, medical coverage, and lost luggage. The company also offers a range of travel advice and support, as well as a 24/7 customer service team.

Users Experience

Trawick International insurance company users have a positive experience with the company. The employees are efficient and knowledgeable, and they go out of their way to help customers. The company’s website is user-friendly, and it is easy to find information about products and services. The company’s claims process is straightforward, and there are no hidden fees. Overall, Trawick International is a reputable insurance company that offers great customer service.

Trawick International is a company that provides insurance for users of the internet. Trawick International insurance company is a well-known provider of insurance products and services.

Insorence Plan

- Trip cancellation: Up to $150,000

- Trip interruption: Up to $225,000

- Trip delay: Up to $1,000

- Baggage: Up to $2,500

- Medical and dental: Up to $100,000

Pros & Cons

Pros

- Get quotes from several credible insurance providers

- Use one app to find multiple kinds of trips

- Check out multiple plans available from insurers to cover your planned vacation

Cons

- Numerous popular insurance companies are do not appear in the listings.

- The initial listing pages don’t include any policy restrictions

- Included are some policies that have a very low coverage limits

When Traveling, Check out these low cost providers.

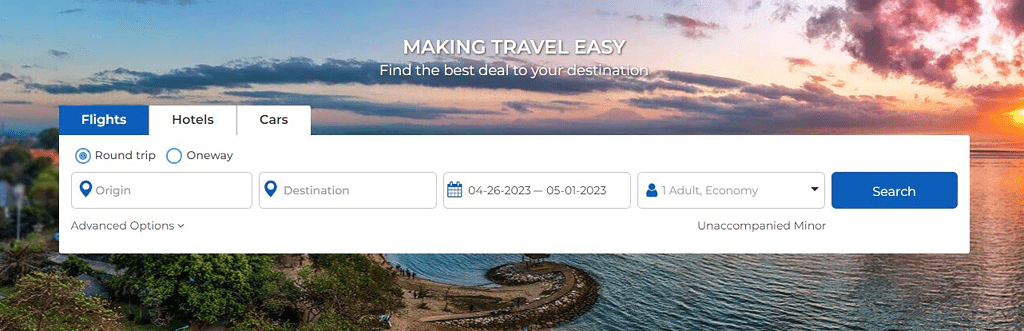

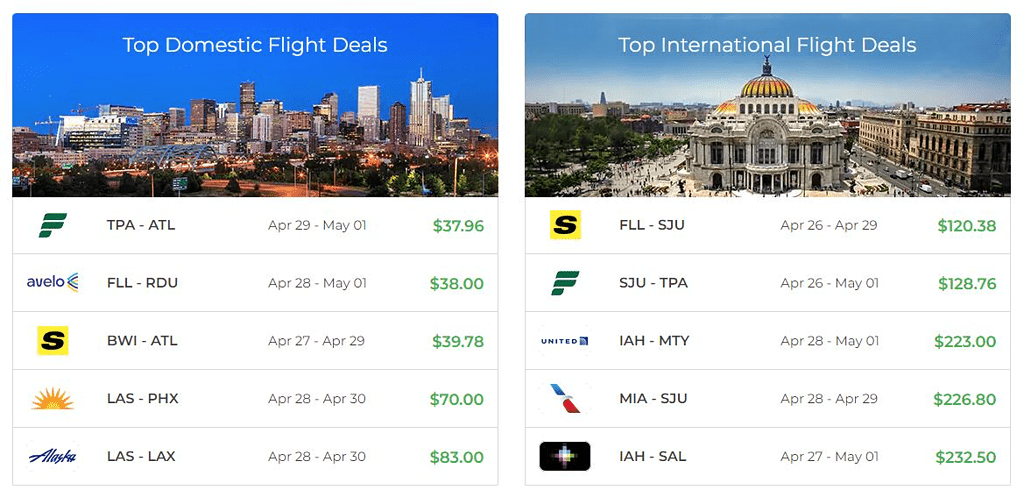

Cheapflightsfares

Cheapflightsfares is an online travel agency that specializes in helping travelers find affordable flights and book air tickets online. The website offers various options for domestic and international flights, including major airlines and low-cost carriers.

The key features of Cheapflightsfares include its user-friendly interface, comprehensive search engine, and competitive pricing. The website also offers a variety of tools and resources to help travelers plan their trip, including information on baggage policies, airport transfers, and travel insurance.

In addition to flights, Cheapflightsfares also offers hotel bookings and car rentals, making it a one-stop shop for all your travel needs. The website offers 24/7 customer support, with a team of travel experts available to assist you with any questions or concerns.

Overall, Cheapflightsfares is a convenient and reliable option for travelers looking to find affordable flights and book air tickets online. With its extensive network of airlines and competitive pricing, the website offers great value for anyone looking to save money on their travel expenses.

Key Features:

1. User-friendly interface: Cheapflightsfares has a clean and intuitive interface that makes it easy for users to search and book flights quickly and efficiently.

2. Comprehensive search engine: The website’s search engine allows users to find flights based on a variety of criteria, including travel dates, destination, and budget.

3. Competitive pricing: Cheapflightsfares offers some of the lowest prices on flights, making it a great option for budget-conscious travelers.

4. Additional travel services: Besides flights, the website also offers hotel bookings and car rentals, making it a one-stop shop for all your travel needs.

5. 24/7 customer support: Cheapflightsfares has a dedicated team of travel experts available 24/7 to assist users with questions or concerns.

User Experience:

As someone who frequently travels for business and leisure, I’ve had my fair share of experiences with online flight booking websites. However, my experience with Cheapflightsfares has been exceptional. The website’s user-friendly interface makes it easy to quickly search for flights based on my preferred dates and destination.

What I love about Cheapflightsfares is the comprehensive search engine that allows me to filter my search results based on my budget, preferred airline, and other criteria. I’ve found that the website consistently offers some of the lowest prices on flights, which has allowed me to save money on my travels. Additionally, the website’s offering of additional travel services like hotel bookings and car rentals has made it a convenient one-stop shop for all my travel needs.

Whenever I’ve had questions or concerns, the 24/7 customer support team at Cheapflightsfares has quickly assisted me. Overall, my experience with Cheapflightsfares has been positive, and I highly recommend it to anyone looking for a reliable and affordable online flight booking website.

Pricing:

Check their website for pricing.

Pros:

1. Transparent pricing: The website provides clear and transparent pricing information, including taxes and fees, so customers can easily compare prices and make informed decisions.

2. Discounts and promotions: Cheapflightsfares regularly offers discounts and promotions on flights, allowing customers to save even more money on their travels.

3. Multiple payment options: The website accepts multiple payment options, including credit cards, PayPal, and even cryptocurrencies, making it easy for customers to book and pay for their flights.

4. Easy cancellation and refunds: In case of changes in travel plans, Cheapflightsfares offers easy cancellation and refund policies with no hidden fees or charges.

5. User-friendly mobile app: The mobile app allows customers to easily search and book flights on the go, making it convenient for those constantly moving.

Cons:

1. Limited customer support: While the website offers 24/7 customer support, some customers have reported long wait times and difficulty reaching a representative.

2. Limited flight options for some regions: Cheapflightsfares may have limited flight options for some regions, especially those with less popular or frequent routes.

Product Reviews:

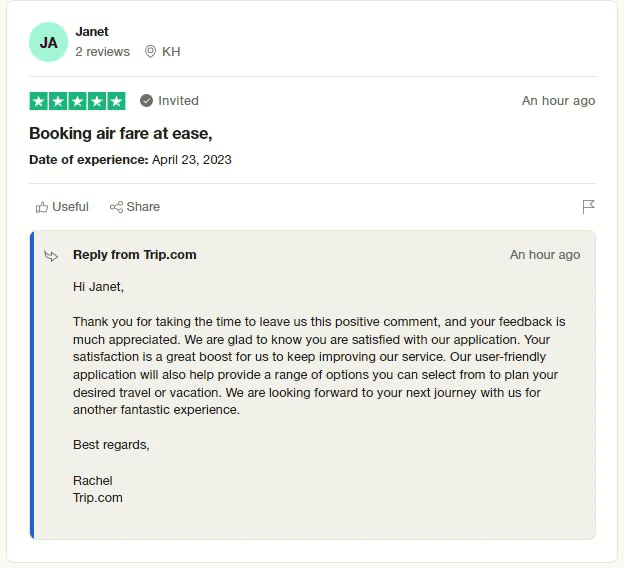

Trip.com

Trip.com is a leading online travel agency that offers various travel-related services, including flights, hotels, vacation packages, and more. With a user-friendly website and mobile app, Trip.com provides customers a convenient and hassle-free way to book their travel plans at competitive prices.

One of the key features of Trip.com is its extensive selection of flights and hotels from around the world. The website allows customers to easily search and compare prices for different airlines and hotels, making it easy to find the best deals and save money. Trip.com offers 24/7 customer support, making it easy for customers to get assistance and support whenever needed.

Another feature of Trip.com is its easy-to-use mobile app, which allows customers to book and manage their travel plans. The app provides real-time flight and hotel information and even offers exclusive discounts and promotions for mobile users.

Overall, Trip.com is a reliable and trusted online travel agency that offers a wide range of travel-related services at competitive prices. With a user-friendly website and mobile app, 24/7 customer support, and a comprehensive selection of flights and hotels, Trip.com is an excellent choice for travelers looking to book their next adventure.

Key Features:

1. Extensive Selection: Trip.com offers an extensive selection of flights, hotels, vacation packages, and more worldwide, making it easy for customers to find the best deals and prices for their travel plans.

2. Easy-to-Use Interface: The website and mobile app feature a user-friendly interface that allows customers to search, compare, and book their travel plans quickly and easily.

3. Mobile App: The Trip.com mobile app provides customers access to real-time flight and hotel information, exclusive mobile discounts, and the ability to manage their travel plans.

4. 24/7 Customer Support: Trip.com offers 24/7 customer support, allowing customers to get assistance and support whenever needed.

5. Best Price Guarantee: Trip.com offers a best-price guarantee on flights, hotels, and vacation packages, ensuring that customers get the best possible prices for their travel plans.

User Experience:

As a frequent traveler, I have had a great experience using Trip.com. The website and mobile app are user-friendly and easy to navigate, making searching for flights, hotels, and vacation packages simple. I appreciate the extensive selection of travel options worldwide, which allows me to compare prices and find the best deals for my travel plans.

The mobile app is especially convenient, as I can easily manage my travel plans and receive real-time flight and hotel information. I also appreciate the 24/7 customer support, which has helped resolve any issues or answer my questions promptly.

Overall, Trip.com has been a reliable and efficient platform for booking my travel plans, and I would recommend it to other travelers looking for a hassle-free booking experience.

Pricing:

Check their website for pricing.

Pros:

1. Competitive prices: Trip.com offers some of the most competitive prices for flights and hotels, making it a great choice for budget-conscious travelers.

2. Extensive selection: With a large selection of flights, hotels, and activities, Trip.com offers plenty of options for travelers.

3. Easy to use: The website is user-friendly, making it easy to search for and book flights, hotels, and other travel arrangements.

4. Rewards program: Trip.com offers a rewards program that allows users to earn points and redeem them for discounts on future bookings.

5. Excellent customer service: Trip.com has a helpful customer service team available 24/7 to assist with any issues or questions.

Cons:

1. Hidden fees: While Trip.com may offer competitive prices, users have reported hidden fees such as booking fees and credit card surcharges.

2. Limited cancellation policies: Some bookings on Trip.com may have limited or non-refundable cancellation policies, which can be frustrating for travelers who need to change their plans.

Product Reviews:

FAQ’s

Why Do I Need Nomad Travel Insurance?

Emergency medical coverage: Health is the most important thing you need when traveling. Emergency medical expenses are always higher for travelers in a foreign country, including newer developing countries. If something unforeseen happens, you might not get treatment or you can end up in serious debt.

A basic travel insurance policy should cover at least $50,000 in emergency medical expenses. You can usually add upgrades for more coverage of up to $250,000.

Emergency medical evacuation coverage: If you are going somewhere isolated with poor medical infrastructure, lack of hospitals then you may need to get evacuated back home for treatment. Travel insurance will cover this as well.

Loss, theft, and damage coverage: If your laptop, an expensive video camera or any of the rest of your electronics that are your “work gear” get stolen, lost or damaged, you will need the insurance to cover the replacement cost! Travel insurance will pay from $500 to $5,000. You can usually buy a package that will cover even more expensive items like your Mac Book Pro at $3,000 a pop.

Trip interruption or cancellation coverage: People traveling anywhere in Spring and Summer of 2020 probably had no idea that they might have difficulties leaving one of the world’s largest cities, as lock downs from the Covid outbreak blocked departures from the international airport.

If you are young, it’s far less expensive: If you are a young traveler (18 to 39) in good physical health, the cost of your travel insurance will be cheaper than for someone who is older and/or has pre-existing health conditions that need to be cared for.

As you can see, travel insurance is not optional, it really is a necessity for a traveler’s peace of mind as well as for their financial and medical security and safety. Just look at the insurance as part of the cost of having a successful vacation.

Which international insurance option is most effective?

Here are the top international health insurance companies.

- Seven Corners

- Generali Global Assistance

- World Nomads

- Travelex

- Allianz

- HTH Travel Insurance and other are mention above

What is the suggested amount of travel-related insurance?

The typical cost for travel insurance ranges from 5-6 percent of the cost of your trip according to Forbes Advisor’s analysis on travel insurance costs. If you are traveling for $5,000 for travel insurance, the median cost is $228. the rates range starting at $154 for a standard policy to $437 for policies with a generous coverage.

Do I require travel insurance if I’m on Medicare?

Short answer: Yes. According to Medicare.gov healthcare coverage that you receive while traveling outside of the U.S. isn’t covered.

Can a person who is 75 have travel insurance?

Certain companies offer one-time or annual travel insurance coverage to holidaymakers and travelers who are older than 75.

Why are travel insurance rates so high right now?

Covid. If you are planning to take longer vacations and travel, your insurance policy will likely be more costly. But please use these suggested companies above and shop around to find the best deal for your individual needs.

Aaron is an educational specialist focusing on jobs that can be performed outside of the standard office and anywhere in the world. Aaron has worked in the Real Estate industry most of his adult life in both commercial and residential. Financial Nomads was created to bring forward the best online educational courses and software reviews to help people live better lives. https://financialnomads.com