15 Best Finance Courses Online Reviewed

In today’s rapidly evolving economy, financial literacy has become an essential skill for individuals and businesses. Understanding how to manage business or personal finances, invest wisely, and analyze financial statements are just some crucial skills that can help individuals make informed decisions and achieve their financial goals.

Whether you’re an entrepreneur looking to manage your company’s finances or an individual looking to invest and grow your wealth, finance courses can provide you with the knowledge and tools necessary to succeed.

With the rise of online learning platforms, accessing high-quality finance courses from the comfort of your own home has never been easier. Online finance courses offer a range of benefits, including flexibility, affordability, and access to a diverse range of courses and programs.

In this article, we will provide an in-depth guide to the best finance courses online, so you can select the course that best suits your needs and interests.

EDX

The course “Finance and Accounting” offered by edX provides an introduction to the fundamentals of finance and accounting. It covers financial statements, ratios, cash flow analysis, budgeting, and capital budgeting. The course is self-paced and requires approximately 12 weeks of study, with an estimated workload of 8-10 hours per week.

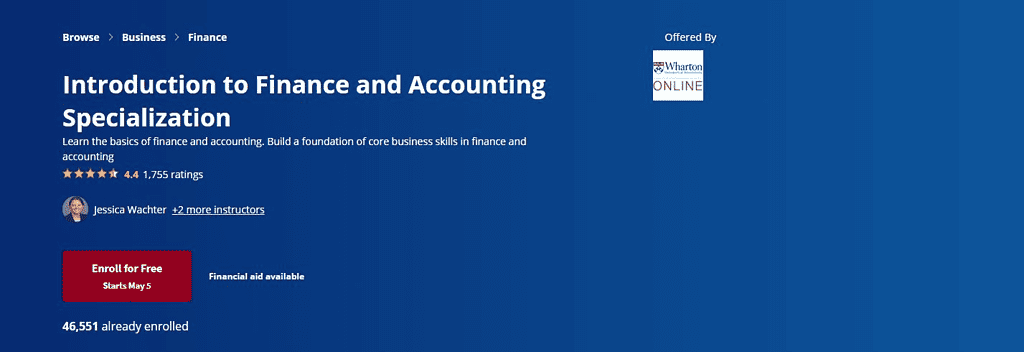

Coursera

The “Introduction to Finance and Accounting Specialization” offered by Coursera is a beginner-level course that provides a solid foundation in the core business skills of finance and accounting. The course, covers the time value of money, risk-return tradeoff, retirement savings, bookkeeping fundamentals, cash flow analysis, and financial reporting.

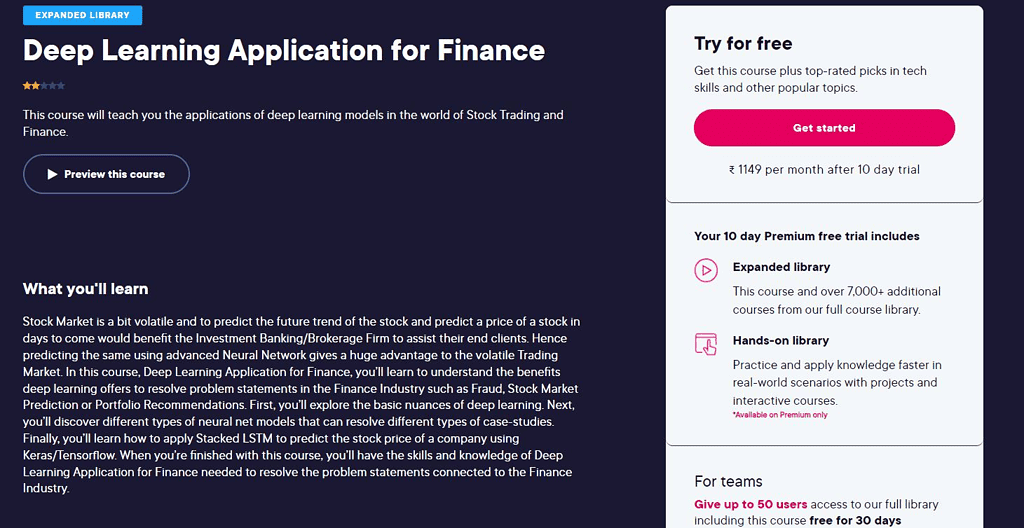

Pluralsight

The course covers the basics of deep learning, explores different types of neural net models, and teaches learners how to apply Stacked LSTM to predict stock prices using Keras/Tensorflow. By the end of the course, learners should have the skills and knowledge needed to tackle problem statements in the modern finance industry using deep learning.

What is Finance Accounting?

Finance accounting, also known as financial accounting, is a branch of accounting that focuses on preparing and presenting financial statements for external stakeholders such as investors, creditors, and regulators.

The primary objective of financial accounting is to provide accurate and timely financial information about an organization’s financial performance, position, and cash flows to enable stakeholders to make informed decisions.

Finance accounting involves recording and summarizing financial transactions using standardized principles and guidelines, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). It also involves analyzing financial data to produce statements, such as income statements, balance sheet, and cash flow statements, which are used to report a company’s financial health and performance.

Finance accounting is crucial in helping businesses make informed decisions, raise capital, attract investors, and comply with regulatory requirements. It is an essential financial management component, encompassing a broad range of activities that include financial planning, budgeting, forecasting, and risk management.

Financial accounting is a fundamental aspect of modern business, providing critical financial information that helps stakeholders make informed decisions.

Factors to Consider When Choosing Finance Courses Online

When looking to take finance courses online, several factors must be considered to ensure that you choose the best program for your needs. Here are some of the key factors to keep in mind:

1. Accreditation: Choosing a program that a recognized accreditation agency accredits is important. Accreditation ensures that the program has met certain quality standards and that employers will recognize your degree or certification.

2. Quality of course materials: The quality of the course materials is another important consideration. Look for programs that offer up-to-date, relevant content that experienced instructors teach. You can read reviews and testimonials from past students to get a sense of the quality of the course materials.

3. Cost: The program’s cost is also an important consideration. Compare the costs of different programs to find one that fits your budget. Remember that some programs may offer financial aid or scholarships to help offset the cost.

4. Availability of tutors and instructors: When you take a course online, you may need additional support to help you understand the material. Look for programs that offer access to tutors or instructors who can answer your questions and provide additional guidance.

5. Flexibility: Finally, consider the flexibility of the program. Look for programs offering self-paced learning or flexible schedules that accommodate your busy life. This will ensure that you can complete the program on time and at your own pace.

By considering these factors when choosing finance courses online, you can find a program that meets your needs and helps you achieve your career goals.

Here are the Best Finance Courses online reviewed

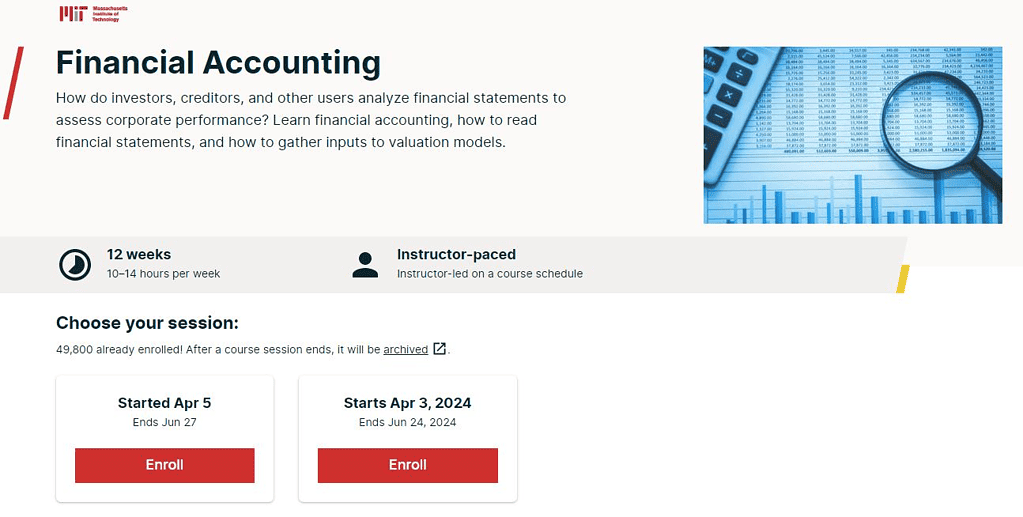

Financial Accounting

The course “Finance and Accounting” offered by edX provides an introduction to the fundamentals of finance and accounting. It covers financial statements, ratios, cash flow analysis, budgeting, and capital budgeting. The course is self-paced and requires approximately 12 weeks of study, with an estimated workload of 8-10 hours per week.

The course is designed for anyone who wants to better understand finance essentials and accounting principles, including students, entrepreneurs, and professionals in other fields. The course is taught by experts from Babson College, one of the world’s top business schools, and includes interactive exercises, quizzes, and case studies to reinforce learning.

Overall, this course is a great way to develop a foundation in finance and accounting, whether you’re looking to advance your career, start your own business, or simply gain skills and a better understanding of financial principles.

Who Is This Course For?

The course is designed for various individuals, including general managers, financial analysts, financial advisor, quantitative researchers, asset managers, risk managers, quantitative developers working in financial services, and professionals servicing the financial industry.

The course is also suitable for undergraduate and graduate students interested in pursuing a career in finance or business. Learners who wish to better understand financial statements, valuation models, and corporate finance decisions can benefit greatly from this course.

However, before taking this course, learners should have a basic understanding of Probability and Statistics, Calculus, and High School Algebra.

What Are The Features & Course Content?

The Finance and Accounting course offered on edX by MITx is part of the MicroMasters Program in Finance and provides learners with a comprehensive understanding of financial accounting principles. The course focuses on preparing and analyzing financial statements, understanding the basic structure of financial reports, and recording transactions. It teaches learners how investors, creditors, and other users analyze financial statements to assess corporate performance.

The course is divided into ten weeks and covers the following topics:

- Accrual accounting

- Revenue recognition and receivables

- Inventory, property, plant, and equipment

- Intangible assets and income vs. cash flows

- Acquisitions and finance investments

- Financial statement analysis (FSA)

- Income taxes and long-term debt

- Leases, stockholders’ equity, and earnings per share

- Accounting for banks

- Tesla case review and accounting for valuation

The course also includes weekly quizzes, high school math, and assignments to help learners assess their understanding of the topics. Upon completing the course, learners will have the knowledge and skills to read financial statements, gather inputs to valuation models, and make sound corporate finance decisions. The course is aimed at general managers, financial analysts, financial advisors, quantitative researchers, asset managers, risk managers, and professionals servicing the financial industry. Undergraduate and graduate students looking to enter business or finance would greatly benefit from this course.

What’s the Duration And Price?

The duration of the “Finance & Accounting” course offered by edX is self-paced, which means you can complete it on your schedule within the course access period. The access to course materials expires on June 28, 2023.

The price of the course depends on the type of track you choose. The audit track is for free online finance courses and provides access to limited course materials. In contrast, the verified track costs $450 and provides access to all course materials, graded assignments, exams, a shareable certificate upon completion, and edX support.

Pros & Cons – Is It Worth Spending?

If you want to learn about financial accounting from experienced instructors and want a verified certificate to showcase your knowledge, then the course may be worth the investment. However, if you are on a tight budget or do not require a certificate, the free audit track may be a better option.

Pros:

- Comprehensive coverage of financial accounting topics, including financial statements, financial analysis, and cash flows.

- Taught by experienced instructors from world-class financial institutions.

- Provides graded assignments and exams to test understanding and reinforce learning.

- Offers a verified certificate upon completion, which can be shared on professional platforms like LinkedIn.

- Provides flexibility to study at your own pace and on your schedule.

Cons:

- The verified track, which provides access to graded assignments and a certificate, has a relatively high price tag of $450.

- The free audit track has limited features and does not include graded assignments or a certificate.

What Are People Saying – Customer Reviews?

The finance and accounting course on edX is a great way to learn about financial statements, budgeting, and financial analysis. The course is suitable for beginners and intermediate learners, and the content is easy to follow. The instructors are knowledgeable and engaging, and the assignments are challenging but manageable. Overall, the course provides a solid foundation in finance and accounting principles, making it a worthwhile investment for anyone interested in the field.

Introduction to Finance and Accounting Specialization

The “Introduction to Finance and Accounting Specialization” offered by Coursera is a beginner-level course that provides a solid foundation in the core business skills of finance and accounting. The course, which takes approximately five months to complete at a suggested pace of two hours per week, covers the time value of money, risk-return tradeoff, retirement savings, bookkeeping fundamentals, cash flow analysis, and financial reporting.

The course is 100% online, allowing learners to start instantly and learn independently. It offers a flexible schedule with set and maintainable deadlines. Learners receive a shareable certificate upon completion. The course is taught by experts from the University of Pennsylvania, one of the Ivy League institutions, and includes subtitles in twelve languages.

Overall, this specialization is a great way to gain a basic understanding of finance and accounting concepts. Its flexible structure makes it accessible to anyone looking to enhance their business skills. The course can benefit students, entrepreneurs, and professionals alike.

Who Is This Course For?

The Introduction to Finance and Accounting Specialization on Coursera is designed for anyone who wants to better understand finance and accounting principles, including students, entrepreneurs, and professionals in other fields.

The course is also suitable for those interested in pursuing a career in finance or accounting, as it provides a solid foundation of core business skills in these areas.

What Are The Features & Course Content?

Each course in the Finance and Accounting Specialization on Coursera has its own set of features and course content. Here is a brief overview of the course:

- Fundamentals of Finance

- Introduction to Corporate Finance

- Introduction to Financial Accounting

- More Introduction to Financial Accounting

All courses in this specialization are self-paced and include interactive exercises, quizzes, and case studies to reinforce learning. The courses are taught by experts from Wharton School, one of the world’s top business schools. Upon completion of each course, learners can earn a certificate to showcase their newly acquired skills.

What’s the Duration And Price?

The duration and price for each course in the Finance & Accounting Specialization on Coursera are as follows:

- Fundamentals of Finance: Self-paced course costs $79 per month with a 7-day free trial.

- Introduction to Corporate Finance: Self-paced, five weeks long, and costs $49 monthly with a 7-day free trial.

- Introduction to Financial Accounting: Self-paced, four weeks long, and costs $49 monthly with a 7-day free trial.

- More Introduction to Financial Accounting: Self-paced, five weeks long, and costs $49 USD monthly with a 7-day free trial.

Alternatively, learners can pay a one-time fee for each course to have full access to the course content and earn a course certificate upon completion. The one-time fee for each course is $199.

Pros & Cons – Is It Worth Spending?

If you want to learn about finance and accounting principles from top business school instructors, then the Finance and Accounting Specialization on Coursera may be worth the investment. With a focus on practical applications, this specialization covers various topics, from basic financial concepts to income statement analysis and corporate finance.

Pros:

- Taught by experts from the University of Pennsylvania’s Wharton School, one of the world’s top business schools.

- Offers a comprehensive overview of finance and accounting topics, including corporate finance, financial statements, and financial analysis.

- It provides a flexible, self-paced learning experience that allows learners to study independently.

- Includes interactive exercises, quizzes, and case studies to reinforce learning and provide hands-on experience.

- Offers a verified certificate upon completion, which can be shared on professional platforms like LinkedIn.

- Provides investment opportunities for networking and collaboration with a global community of learners.

Cons:

- The specialization consists of four courses, each with its fee, which can add up to a significant investment.

- The verified certificate option, which provides access to graded assignments and a certificate, can be expensive compared to other online courses.

What Are People Saying – Customer Reviews?

The Finance and Accounting Specialization on Coursera is a great choice for anyone looking to develop their knowledge and skills in a corporate environment, financial accounting, and related areas.

Experienced instructors from world-class institutions teach the courses and cover various topics, including financial statements, investment analysis, and valuation.

The flexibility to study at your own pace and schedule is a big plus, and the graded assignments and exams help reinforce learning. While the verified certificate option has a high price tag, it may be worth the investment for those looking to showcase their knowledge on professional platforms like LinkedIn.

Overall, the Finance and Accounting Specialization on Coursera is a valuable resource for anyone looking to enhance their financial expertise.

Deep Learning Application for Finance

The “Deep Learning Application for Finance” course on Pluralsight aims to teach learners the benefits of using deep learning to solve various problem statements in the finance industry, including fraud detection, stock market prediction, and portfolio recommendations.

The course covers the basics of deep learning, explores different types of neural net models, and teaches learners how to apply Stacked LSTM to predict stock prices using Keras/Tensorflow. By the end of the course, learners should have the skills and knowledge needed to tackle problem statements in the modern finance industry using deep learning.

Who Is This Course For?

This course, “Deep Learning Application for Finance,” is designed for individuals interested in using deep learning techniques to solve finance-related problems, such as fraud detection, stock market prediction, or portfolio management.

It is suitable for professionals in the finance industry, such as investment bankers, traders, analysts, or brokers, who want to enhance their skills in using advanced machine learning and smart tools to gain insights from financial models.

What Are The Features & Course Content?

Experienced instructors teach the course, and it includes the following features and content:

- Introduction to deep learning and its applications in finance

- Types of neural network models and their use cases

- Preparing data for deep learning models

- Building a stacked LSTM model for stock price prediction

- Evaluating model performance and tuning hyperparameters

- Deploying and using the trained model

Throughout the course, learners will have access to hands-on exercises and real-world case studies to reinforce their understanding and gain practical experience in using deep learning algorithms in finance.

What’s the Duration And Price?

The “Deep Learning Application for Finance” course on Pluralsight is 2 hours and 23 minutes.

The course costs $22 per month after a 10-day free trial. With a Pluralsight subscription, you can access over 7,000 additional courses from their full course library.

Pros & Cons – Is It Worth Spending?

If you are interested in applying deep learning algorithms to financial applications and are comfortable with a self-directed learning approach, this course is worth considering. The hands-on projects and affordable subscription model make it a cost-effective way to gain valuable skills in deep learning for finance.

Pros:

- Comprehensive coverage of deep learning applications in finance, including stock market prediction and fraud detection.

- Taught by experienced instructors with real-world experience in finance and deep learning.

- Hands-on projects and exercises that allow learners to apply their knowledge in real-world scenarios.

- Access to a large library of courses and learning resources on Pluralsight.

- Affordable monthly subscription model with a free trial period.

Cons:

- The course focuses primarily on using stacked LSTM for stock market prediction and does not cover other deep learning algorithms in as much depth.

It may not be suitable for complete beginners to deep learning, as the course assumes a basic understanding of neural networks.

What Are People Saying – Customer Reviews?

The Deep Learning Application for Online Finance course on Pluralsight provides a great introduction to using deep learning algorithms in the finance industry. The course covers the basics of deep learning and its importance in predicting stock prices and using stacked LSTM. The course is well-structured and easy to follow, making it a valuable resource for those interested in finance and deep learning. Overall, it is worth the investment for those looking to enhance their skills in this field.

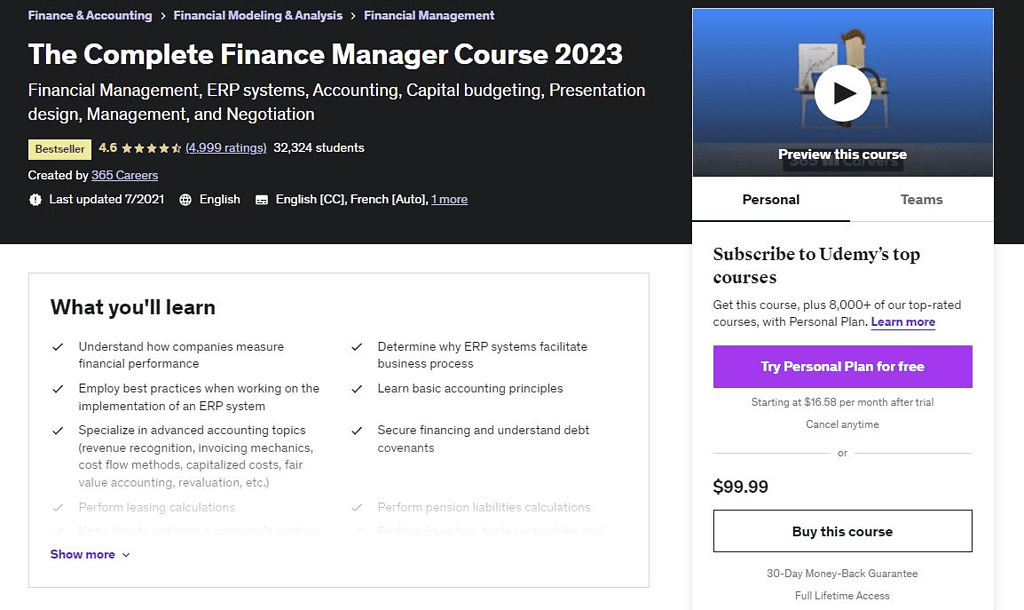

The Complete Finance Manager Course

The Complete Finance Manager Course” on Udemy is a comprehensive financial management course that covers 11 different courses, including enterprise resource planning (ERP) systems, accounting basics, financial statement analysis, capital budgeting, and negotiation.

The course is taught by experienced professionals who have worked for companies like PwC, Coca-Cola Enterprises, HSBC, and Morgan Stanley. The course includes 13 hours of on-demand video, assignments, articles, downloadable resources, closed captions, and a certificate of completion.

The course also provides 10 Course Challenges, allowing learners to reinforce their knowledge and receive personalized feedback. By the end of the course, learners should have the skills and preparation needed to become successful finance managers.

Who Is This Course For?

This course is designed for individuals interested in pursuing a career in finance or enhancing their financial management skills. It suits financial analysts, accountants, controllers, business analysts, and financial consultants. Aspiring finance managers, bankers, Indiana University graduates, and finance students can also benefit from this course. Essentially, anyone interested in becoming a finance manager can enroll.

What Are The Features & Course Content?

The “Complete Finance Manager Course” on Udemy offers a comprehensive curriculum on finance management, covering topics such as.

- Accounting Basics

- Advanced Accounting

- Sources of Financing

- Financial Statement Analysis

- Working Capital Management

- Capital Budgeting

- Becoming a Manager

By the end of the course, learners will have a strong foundation in finance management and the skills necessary to make informed financial decisions. They will also have the opportunity to earn a certificate of completion to showcase their proficiency in finance management.

What’s the Duration And Price?

The duration of the “Complete Finance Manager Course” on Udemy is not specified, but it includes 26 sections with 126 lectures. The course is currently priced at $17.99 with an original price of $99.99, which is an 82% discount. Additionally, Udemy offers a 30-day money-back guarantee and lifetime access to the course materials.

Pros & Cons – Is It Worth Spending?

If you want to learn about applying deep learning algorithms in the finance industry, then The Complete Finance Manager Course on Udemy may be worth the investment. With a focus on practical applications, this course covers the basics of deep learning, types of neural network models, data preparation, building a stacked LSTM model for stock price prediction, and model evaluation and deployment.

Pros:

- Taught by experienced instructors with practical experience in applying deep learning algorithms in the finance industry.

- Covers various topics related to using deep learning in finance, including stock price prediction and fraud detection.

- Includes hands-on exercises and real-world case studies to reinforce learning and provide practical experience.

- Provides lifetime access to course materials, allowing learners to revisit content anytime.

- Offers a 30-day money-back guarantee, providing learners a risk-free way to try the course.

Cons:

- The course is focused solely on deep learning in finance and does not cover other aspects of finance and accounting.

- The course does not offer a verified certificate option, which may be a drawback for learners looking to showcase their skills on professional platforms.

What Are People Saying – Customer Reviews?

I found The Complete Finance Manager Course on Udemy an excellent resource for learning about deep learning applications in finance. The course content was well-structured, and the instructors were knowledgeable and engaging. The hands-on exercises and real-world case studies were particularly helpful, and I feel confident in my ability to apply what I learned to real-world problem statements. Overall, I highly recommend this course to anyone interested in learning about deep learning in finance.

Project and Infrastructure Financing

The “Project Finance and Infrastructure Financing” course on Edureka provides learners with a comprehensive understanding of project finance and infrastructure financing. Learners will gain insight into project financing structures, risk analysis, and financing agreements through practical examples and case studies.

The course also covers project appraisal and evaluation, loan syndication, and government policies and regulations related to project financing. By the end of the course, learners should be able to apply project finance concepts to real-world situations and make informed decisions about infrastructure investments.

Who Is This Course For?

This course is designed for professionals in the finance and investment industry who are interested in learning about project and infrastructure financing. It is also suitable for students and individuals who want to enhance their knowledge. Basic knowledge of finance is recommended.

What Are The Features & Course Content?

The “Project and Infrastructure Financing” course on Edureka is designed to equip participants with the knowledge and skills needed to approach infrastructure projects from the equity, debt, and hybrid instruments standpoint. The curriculum includes:

- Introduction to Project and Infrastructure Finance

- The Syndication Process

- Risk Analysis and Risk Allocation

- Capital Budgeting

- Financial Sustainability of an Infrastructure Project

- Technical Aspects of Loan Agreements

Through the course, learners can access self-directed training with structured learning materials, including videos, PPTs, assignments, projects, and other activities. Upon completion, learners will have the necessary expertise to navigate project financing in the infrastructure sector.

What’s the Duration And Price?

The duration of the “Project and Infrastructure Financing” course on Edureka is not mentioned on their website. The course price is $179.

Pros & Cons – Is It Worth Spending?

If you are interested in learning about project and infrastructure financing, then the Project and Infrastructure Financing course on Edureka may be worth considering. Here are some pros and cons to help you make your decision:

Pros:

- Taught by industry experts with years of experience in project and infrastructure financing.

- Covers various topics related to project financing, including financial risk analysis, capital budgeting, and loan agreements.

- Includes practical assignments and case studies to provide a hands-on learning experience.

- Provides lifetime access to course materials, allowing learners to revisit content anytime.

- Offers an option to pay later, which can be convenient for learners on a tight budget.

Cons:

- The course is focused solely on project and infrastructure financing and does not cover other aspects of finance and accounting.

- The course does not offer a verified certificate option, which may be a drawback for learners looking to showcase their skills on professional platforms.

What Are People Saying – Customer Reviews?

The Project and Infrastructure Financing course on Edureka is an excellent program for those interested in learning about infrastructure investments. The course material is well-structured and offers a practical approach to project financing. The instructors are knowledgeable and experienced, and the course offers lifetime access to materials. The only downside is that the course is slightly expensive, but the knowledge gained is worth the investment.

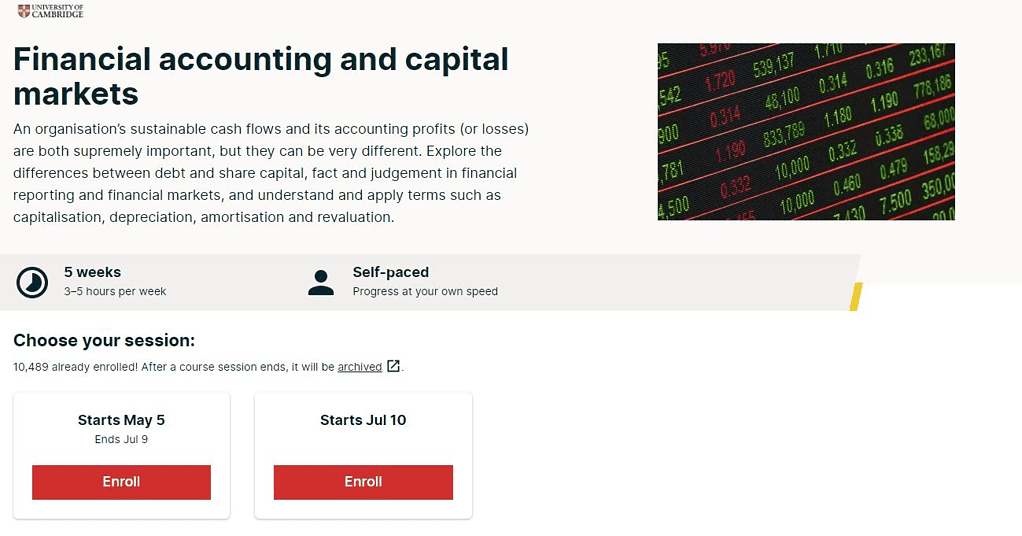

Financial Accounting and Capital Markets

The “Financial Accounting and Capital Markets” course on edX is a five-week intermediate-level course offered by the University of Cambridge. The course covers financial accounting, capital markets, and the relationships between them.

Learners will better understand cash flow versus profit, accruals accounting, capitalization, depreciation, amortization, revaluation, financial modeling, and financial sensitivities.

The course includes case studies, mini-quizzes, and expert lectures, and learners will develop practical skills that can be applied to strategic financial decision-making and financial modeling. Completing the course will equip learners with the knowledge to understand and apply sustainable finance and identify the next steps for further learning.

Who Is This Course For?

The Financial Accounting and Capital Markets course on edX is designed for learners interested in understanding financial accounting and its relationship with capital and financial markets. This course is ideal for intermediate-level learners with a background in finance or accounting.

What Are The Features & Course Content?

The “Financial Accounting and Capital Markets” course on edX covers various topics related to financial accounting and capital markets. The course is taught for five weeks and includes the following content:

- Cash flow versus profit; Accruals and accruals accounting

- Capitalization, Depreciation, Amortisation, and Revaluation

- Financial modeling and Financial sensitivities

- Debt capital markets and Loan markets

- Equity capital markets and Private Equity

The course also includes case studies, mini-quizzes, and expert lectures to reinforce learning and provide practical experience. Upon completion of the course, learners will have a strong foundation in financial accounting and capital markets and be able to apply their skills to make informed financial decisions.

What’s the Duration And Price?

The duration of the Financial Accounting and Capital Markets course on edX is five weeks, with an estimated effort of 3-5 hours per week. The course is self-paced, allowing learners to progress at their speed.

The course is available in both the Audit and Verified tracks, with the Verified track costing $199 and offering additional features such as graded assignments and exams, a shareable certificate upon completion, and access to edX support. The Audit track is free, but access to course materials is limited, and the certificate of completion is unavailable.

Pros & Cons: Is It Worth Spending?

The “Financial Accounting and Capital Markets” course on edX is worth considering for anyone interested in gaining a solid foundation in financial accounting and capital markets. With its comprehensive curriculum, prestigious institution, and flexible learning options, this course can help learners acquire valuable skills and enhance their career prospects in the finance industry.

Pros:

- Taught by experts from the University of Cambridge, a prestigious institution known for its excellence in economics and financial education.

- Provides learners with a comprehensive understanding of financial accounting, capital markets, and their relationships, equipping them with valuable skills that can be applied in the real world.

- Includes case studies and mini-quizzes to reinforce learning and ensure practical understanding.

- Offers both a verified and an audit track, providing learners with flexibility in choosing their learning path and cost options.

- Provides learners with a shareable certificate upon completion, which can enhance their credibility and boost their career prospects.

Cons:

- The course has a specific focus on financial accounting and capital markets, which may not be suitable for learners interested in other finance areas.

- The course has a fixed duration of 5 weeks, which may not be enough for some learners to fully grasp all the concepts and apply them in practice.

What Are People Saying – Customer Reviews?

I recently completed the Financial Accounting and Capital Markets course on edX, and it was an excellent learning experience. The course covered various topics related to financial accounting and capital markets, including cash flow, accruals accounting, financial modeling, debt and equity markets, and more.

The course content was well-structured and easy to follow, and the instructors were knowledgeable and engaging. Overall, I highly recommend this course to anyone looking to gain a deeper understanding of financial accounting and global markets.”

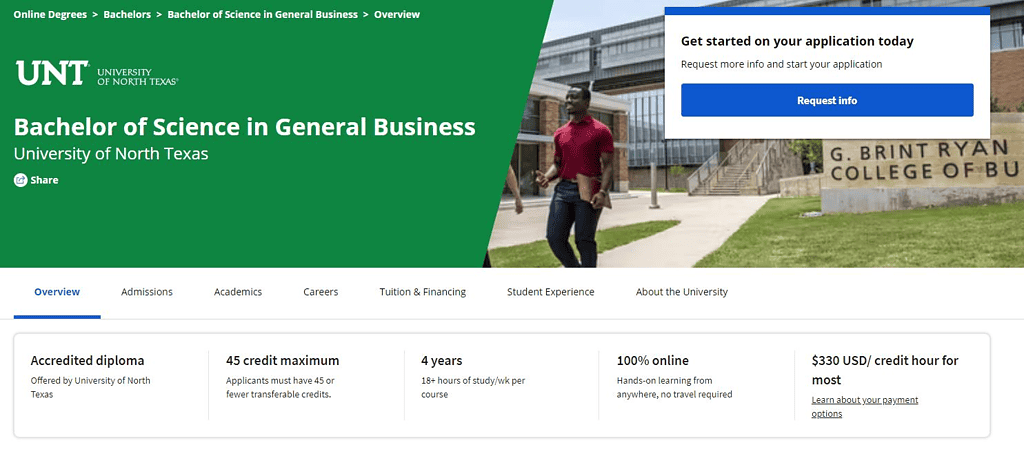

Bachelor of Science in General Business

The Bachelor of Science in General Business degree offered by the University of North Texas (UNT) is a fully online program on Coursera. This program provides students with a foundational business education that emphasizes developing practical job skills through a flexible, hands-on approach.

The program covers all key business areas, including economics, accounting, finance, business analytics, information systems, management, and marketing. It also offers paid internship opportunities facilitated and supervised by UNT, or students can bring in their internships. Management and marketing courses provide additional preparation for success in these high-demand business areas.

This degree is accredited by the Association to Advance Collegiate Schools of Business (AACSB) and is intended for students with 45 or fewer transferable credit hours.

Who Is This Course For?

The Bachelor of Science in General Business is a flexible and affordable program for those with 45 or fewer transferable college credits or who want to advance their career pathway. It offers net present value and prepares students for an MBA program from UNT.

The program provides interactive training and a well-rounded understanding of all key business areas. By applying before the priority deadline, students can engage with financial advisor and become eligible for a larger pool of financial aid funding sooner.

What Are The Features & Course Content?

The Bachelor of Science in General Business program at the University of North Texas (UNT) is offered on Coursera and covers various business-related topics.

- Includes UNT core curriculum requirements

- Pre-business/lower-level foundation requirements

- Professional development courses

- Basic business foundation requirements

- Advanced-level business courses

- Applied business project course or internship

The program provides students with a strong foundation in various business disciplines, practical experience through the Applied Business Project Course or Internship, and the opportunity to tailor their learning towards a specific career path through the management or marketing concentration.

What’s the Duration And Price?

The Bachelor of Science in General Business program offered by the University of North Texas is 4-year. The program requires 120 credit hours, and students should plan to study 18+ hours per week per course. The program is 100% online, with no travel required.

The program costs $330 per credit hour for most students, with some exceptions. There may be additional fees such as application fees, technology fees, and textbooks. Students can learn about their payment options, including financial aid and scholarships, by contacting the university’s financial aid office.

Pros & Cons – Is It Worth Spending?

The Bachelor of Science in General Business offered by the University of North Texas is a great option for those seeking a business degree. Here are the pros and cons to consider:

Pros:

- Accredited diploma from a reputable institution.

- The program is 100% online, allowing students to learn from anywhere.

- Affordable tuition rates, with payment options available.

- Hands-on learning opportunities to gain practical skills and experience.

- Four-year program provides ample time for students to complete the degree.

Cons:

- Applicants must have 45 or fewer transferable credits, limiting options for those who have already completed a significant amount of coursework.

- Students must complete 18+ hours of study per week per course, which may be challenging for those with busy schedules.

What Are People Saying – Customer Reviews?

The Bachelor of Science in General Business degree offered by UNT is an excellent option for anyone looking to earn a degree in business studies online. The program is flexible and affordable and provides hands-on learning opportunities from anywhere. Upon completion, graduates will be equipped with valuable skills to pursue a career in business. Overall, it’s a great choice for those seeking a convenient and reputable online business degree.

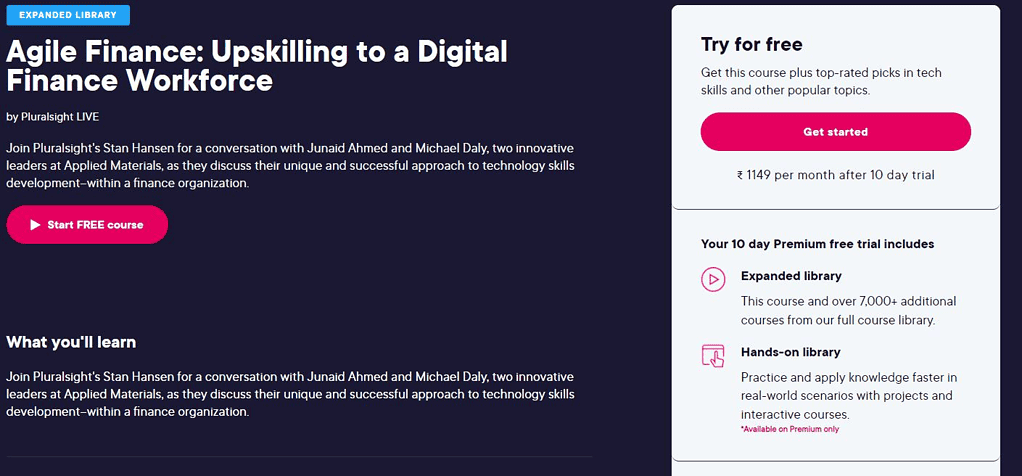

Agile Finance: Upskilling to a Digital Finance Workforce

The Agile Finance: Upskilling to a Digital Finance Workforce is a digital event focusing on the intersection of finance and technology. The course features expert speakers who share insights on how finance professionals can use agile methodologies to enhance their decision-making, increase efficiency, and drive innovation.

Topics covered in the course include agile finance practices, digital transformation, and automation in finance. The course is designed for finance professionals, accounting professionals, and anyone interested in learning about agile finance’s latest trends and investment strategies.

Who Is This Course For?

As the course “Agile Finance: Upskilling to a Digital Finance Workforce” covers a range of topics related to digital finance and agility, it is ideal for finance professionals, accounting professionals, and anyone interested in upskilling their finance capabilities.

The course is designed to cater to learners at various levels, from entry-level professionals to senior executives. Additionally, anyone interested in digital finance transformation and agile methodologies can benefit from this course.

What Are The Features & Course Content?

The course “Agile Finance: Upskilling to a Digital Finance Workforce,” offered by Pluralsight Live 2020, provides learners with a comprehensive understanding of agile finance concepts and how they can be applied in practice to upskill their digital finance workforce. The course is designed for finance professionals, including CFOs, financial analysts, and accountants, who want to enhance their skills and stay competitive in the financial services industry.

The course covers a wide range of topics, including:

- The basics of agile finance, including its principles, frameworks, and practices.

- How to apply agile finance concepts to drive innovation and improve business outcomes.

- Strategies for transforming finance operations using agile methodologies and digital technologies.

- Best practices for building high-performing agile teams in the finance department.

- Real-world case studies and examples of how agile finance has been successfully implemented in different organizations.

The course is taught by experienced instructors with expertise in finance and agile methodologies, providing learners with practical insights and hands-on experience. Upon completion of the course, learners will have a solid foundation in agile finance and be able to apply their skills to transform finance operations and drive business growth.

What’s the Duration And Price?

According to the Pluralsight website, the course is approximately 35 minutes long. Remember that this may vary depending on the individual’s pace of learning and engagement with the course material.

Pluralsight offers this course, but they have different pricing plans and subscription options, so the duration and price may vary depending on your chosen plan.

What Are People Saying – Customer Reviews?

The Agile Finance: Upskilling to a Digital Finance Workforce course offered by Pluralsight is worth considering for anyone interested in upskilling and transforming their career in the digital finance industry.

Pros:

- The course offers a comprehensive understanding of the principles and practices of Agile Finance, providing learners with practical skills to upskill and transform their career prospects in the digital finance industry.

- The course is self-paced, allowing learners to learn at their own pace and convenience.

- The course is delivered by experts in the field, ensuring the quality and relevance of the content.

- The course offers hands-on learning with real-world case studies, providing learners with practical experience and application of Agile Finance concepts.

- The course is available on Pluralsight, a reputable online learning platform that offers a wide range of courses and resources to support learners in their learning journey.

Cons:

- The course may not be suitable for learners who are not interested in the digital finance industry or have a limited understanding of basic finance concepts.

- The course may require some prior knowledge or experience in finance or related fields, which could challenge some learners.

What Are People Saying – Customer Reviews?

Agile Finance: Upskilling to a Digital Finance Workforce” is a highly valuable course for anyone seeking to enhance their financial skills and adapt to the digital age. The course covers various topics, from agile methodologies to emerging technologies, and is taught by experienced instructors. With its flexible learning options and affordable pricing, this course is worth considering for anyone looking to upskill and stay ahead in the finance industry.

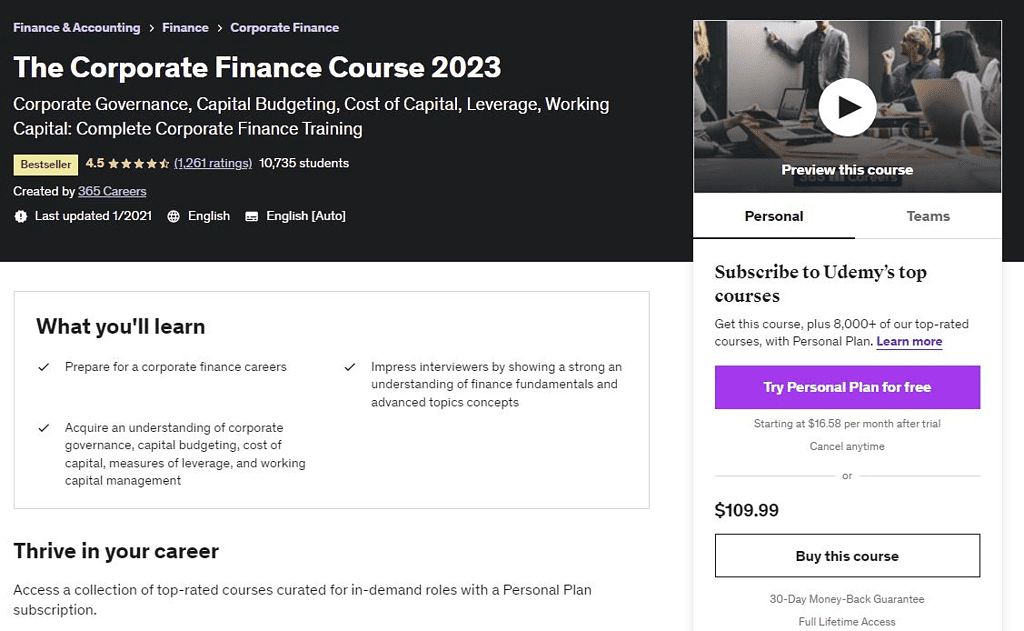

The Corporate Finance Course 2023

The “Corporate Finance Course” on Udemy is a comprehensive online training program that covers the core principles and practical applications of corporate finance. This course provides a deep understanding of corporate governance, capital budgeting, cost of capital, leverage, and working capital and includes practical examples and challenges to reinforce learning.

The course is designed to deliver the ultimate training experience through beautiful animations and interactive content. The instructor offers an unconditional 30-day money-back guarantee for students. With its comprehensive curriculum and practical approach, this course is an excellent resource for anyone seeking to gain expertise in corporate finance.

Who Is This Course For?

The Corporate Finance Course on Udemy is designed for individuals who want to gain knowledge and skills in corporate finance, including professionals who work in the finance industry, business owners, managers, students, and anyone interested in learning about corporate finance. The course is suitable for beginners and intermediate learners who want to learn about corporate governance, capital budgeting, cost of capital, leverage, and working capital.

What Are The Features & Course Content?

The Corporate Finance Course 2023 is a comprehensive training opportunity to provide learners with a complete understanding of corporate finance concepts and their practical applications.

The course is divided into five main sections:

- Working Capital Management

- Capital Budgeting

- Cost of Capital

- Measures of Leverage

- Corporate Governance and ESG

Finally, the course comes with an unconditional 30-day money-back guarantee, ensuring that learners have no risk investing in this training opportunity. By the end of this course, learners will have a solid foundation in corporate finance and be able to apply their skills to excel in their careers and drive business growth.

What’s the Duration And Price?

The course is 8 sections and 84 lectures, with a total length of 5 hours and 39 minutes. The price of the course is $18.99.

Pros & Cons – Is It Worth Spending?

The course can be a good investment for learners who want to gain a foundational understanding of corporate finance at an affordable price. However, learners should remember that the course may not be sufficient on its own to become an expert in the field and may need to supplement their learning with additional resources.

Pros:

- The course covers essential topics in corporate finance, providing learners with a comprehensive understanding of the subject.

- The course is taught by an experienced instructor who has worked in the finance industry for over 20 years.

- The course includes real-world examples and case studies, which help learners understand how the concepts apply in practice.

- The course is relatively affordable, making it accessible to a wider audience.

Cons:

- The course is not in-depth, and learners may need to supplement their learning with additional resources to fully grasp the subject.

- The course does not provide certification upon completion, which may be important for learners who want to showcase their skills to employers.

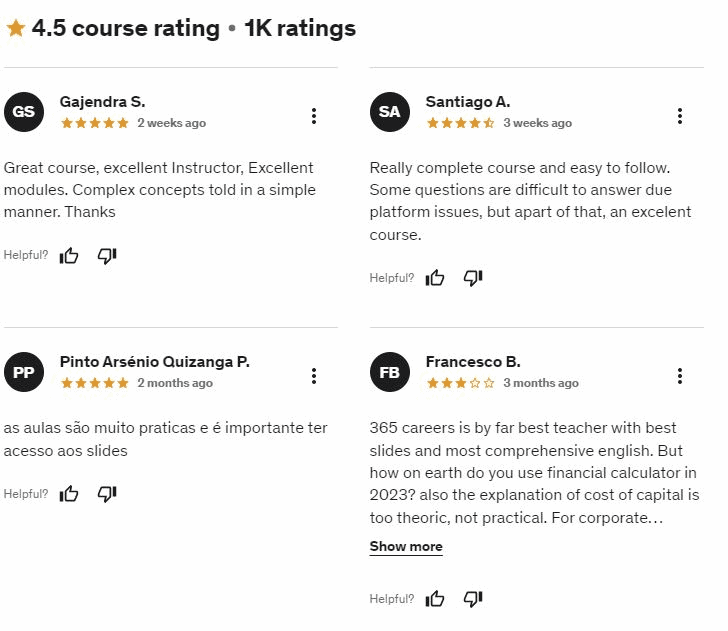

What Are People Saying – Customer Reviews?

“The Corporate Finance Course 2023” is an excellent course for anyone looking to expand their knowledge of corporate finance. The content is well-structured and covers various topics, including working capital management, capital budgeting, and cost of capital. The instructors are knowledgeable and engaging, making the learning experience enjoyable. Overall, I highly recommend this course to anyone interested in advancing their career in finance.

Financial Accounting Fundamentals

Southern New Hampshire University offers the Financial Accounting Fundamentals course through edX and introduces learners to the basic principles and concepts of financial accounting.

The course is designed for individuals with little to no accounting background and is suitable for anyone interested in understanding how financial statements are prepared and analyzed. Through this course, learners will understand accounting standards, financial statements, and financial analysis comprehensively.

The self-paced course includes video lectures, interactive quizzes, and real-world examples to help learners apply the concepts learned. Upon completion, learners will have the foundational knowledge to analyze financial statements and make informed business decisions.

Who Is This Course For?

The Financial Accounting Fundamentals course is ideal for individuals new to accounting or those who want to refresh their knowledge of basic accounting concepts. This course is also suitable for business owners, entrepreneurs, or managers who want to understand financial statements to make informed business decisions. Additionally, students preparing for accounting exams or pursuing an accounting degree can benefit from this course.

What Are The Features & Course Content?

The “Financial Accounting Fundamentals” course offered by edX covers a comprehensive set of features and course content.

- The basics of accounting and financial statements

- Accounting rules and regulations

- Analyzing and interpreting financial statements

- Financial reporting for different stakeholders

- The Role of Accounting in Decision-making

- Accounting for assets and liabilities

- Inventory valuation methods

- Understanding long-term debt and equity

- Financial statement analysis

- Using accounting information for budgeting and forecasting

Through these features and course content, learners will develop a strong foundation in financial accounting and be equipped with practical skills for recording and reporting financial transactions, preparing financial statements, and analyzing financial data.

What’s the Duration And Price?

he course lasts 16 weeks, and the price of the verified track is $498. However, a free audit track is available, which provides access to the course materials with limited features.

Pros & Cons: Is It Worth Spending?

Yes, the Financial Accounting Fundamentals course is worth the investment for those looking to understand accounting principles and practices. The course is self-paced, accessible, and offers a certificate upon completion, making it a valuable addition to any resume or portfolio.

Pros:

- Comprehensive coverage of financial accounting principles and practices.

- Self-paced and flexible learning options to fit any schedule.

- Free access to course materials, making them accessible to anyone.

- Graded assignments and exams to track progress and assess learning.

- A shareable certificate upon completion, which can enhance career prospects and add credibility to one’s resume.

Cons:

- There is no direct interaction with instructors or peers, which may hinder the learning experience for some.

- Limited access to some course features in the free version, such as graded assignments and exams.

What Are People Saying – Customer Reviews?

Financial Accounting Fundamentals is an introductory-level course that provides learners with a solid foundation in accounting principles and practices. The course covers various financial transactions and how they are recorded, analyzed, and reported to stakeholders. Learners will also gain an understanding of financial statements, including balance sheets, income statements, and cash flow statements. Overall, the course is a great choice for anyone seeking a basic understanding of financial accounting.

Introduction to Corporate Finance

The Introduction to Corporate Finance course offered by the Wharton School at the University of Pennsylvania on Coursera is designed to provide learners with an overview of the fundamentals of finance and how they are applied to real-world situations in personal finance, corporate decision-making, and financial intermediation.

The course covers key concepts such as the time value of money, risk-return tradeoff, cost of capital, interest rates, retirement savings, mortgage financing, and more.

The William H. Lawrence Professor of Finance at the Wharton School, Michael R Roberts, teaches the course. It is part of multiple free online programs, including the Business Foundations Specialization, Introduction to Finance and Accounting Specialization, and Finance & Quantitative Modeling for Analysts Specialization.

Who Is This Course For?’

This course, Introduction to Corporate Finance, is suitable for anyone who wants to understand behavioral finance and its application in personal finance, corporate decision-making, and financial intermediation. It is particularly relevant for those interested in pursuing a career in finance or related fields. This personal finance course does not require any prior knowledge or experience in finance, making it accessible to beginners.

What Are The Features & Course Content?

The University of Pennsylvania offers the “Introduction to Corporate Finance” course through the online platform Coursera. Here are some of the features and course content:

The course covers the following topics:

- Time value of money

- Interest rates

- Discounted cash flow analysis

- Return on investment

Overall, the course provides a comprehensive introduction to corporate finance, focusing on key concepts and their practical applications. It is suitable for learners who want to gain a foundational understanding of finance for personal or professional reasons.

What’s the Duration And Price?

The Introduction to Corporate Finance course is estimated to take 1-6 months, with a recommended pace of 5 hours per week. The course costs $53 per month, and the total cost of completing the course is $158.

Pros & Cons: Is It Worth Spending?

Introduction to Corporate Finance is a great course for those seeking to gain a solid understanding of finance fundamentals. The course is affordable, accessible, and taught by an expert. While there are some limitations regarding interaction and assessment, the course offers excellent value for the price and is worth spending time and money on.

Pros:

- Comprehensive coverage of key concepts and applications of corporate finance.

- Taught by a renowned finance professor from the prestigious Wharton School at the University of Pennsylvania.

- Self-paced learning and flexible scheduling.

- Affordable and accessible, with EMI payment options available.

- Includes a shareable certificate of completion from the University of Pennsylvania.

Cons:

- Limited interaction with the instructor and other students.

- No graded assignments or exams.

What Are People Saying – Customer Reviews?

This course is a great introduction to finance, covering key concepts such as the time value of money, cost of capital, and discounted cash flow analysis. The instructor, Michael R. Roberts, is an experienced finance professor from the prestigious Wharton School at the University of Pennsylvania. The course is well-structured and easy to follow, with practical examples that make the concepts more relatable. Overall, I highly recommend this course to anyone interested in finance or looking to improve their financial literacy.

Exploring Product Finance

“Exploring Product Finance” is a course offered by Pluralsight, an online learning platform. The course is designed for Product Managers responsible for managing product performance and contributing to financial forecasting and pricing decisions.

The course covers important financial concepts such as income statements and balance sheets, forecasting models, and pricing considerations. The course provides learners with tools and frameworks to help them manage money and product finance effectively and contribute to strategic discussions with business leaders. It includes video lectures, hands-on exercises, and assessments to measure progress.

Who Is This Course For?

This course is designed for product managers who want a deeper understanding of product finance, financial statements, forecasting, and pricing models. It is also suitable for professionals who work closely with product managers and want to understand the financial aspects of product management. Additionally, this course may be helpful for individuals who are interested in a career in product management or finance.

What Are The Features & Course Content?

Pluralsight, a leading online learning platform, offers the “Exploring Product Finance” course. Here are some of the features and course content:

The course is divided into three main sections:

- Managing Products with Financial Statements

- Exploring Product Forecasting

- Understanding Product Pricing Considerations

Overall, the course provides a comprehensive introduction to product finance, focusing on key concepts and practical applications. It is suitable for product managers and professionals who want to enhance their understanding of financial management in the context of product development and management.

What’s the Duration And Price?

The “Exploring Product Finance” course on Pluralsight is 41 minutes. This course costs $14 per month after a 10-day free trial period.

Pros & Cons: Is It Worth Spending?

Whether it is worth spending on the course ultimately depends on the individual’s goals and needs. The course may be a good fit if someone is looking for a brief and focused introduction to managing product finance.

Pros:

- The course offers concise and focused lessons with a relatively short duration of 41 minutes, making it easy to fit into a busy schedule.

- The course is affordable at $14 per month and offers a 10-day trial period for learners to determine if it is a good fit.

- The course provides practical skills and knowledge directly applicable to managing product finance in a business setting.

- Experienced instructors teach the course with a background in finance and product management.

- The course offers flexible learning, as it is available online and can be accessed from anywhere with an internet connection.

Cons:

- The course is short and may not provide a comprehensive understanding of product finance.

- The course focuses on product finance and may not provide a broad overview of finance topics.

What Are People Saying – Customer Reviews?

The ‘Exploring Product Finance’ course on Pluralsight is a fantastic resource for product managers and other professionals who want to better understand financial statements, forecasting, and pricing. The course is well-structured and easy to follow, with clear explanations and examples.

The instructor is knowledgeable and engaging, making the content even more accessible. However, the course may not be suitable for those seeking more advanced or specialized finance topics. Overall, I highly recommend this course for anyone looking to improve their product finance skills.

The Complete Financial Analyst Course 2023

The Complete Financial Analyst Course on Udemy is a comprehensive and practical course covering everything from Microsoft Excel and PowerPoint to financial statements and business analysis.

The course is designed for beginners and intermediate users and provides extensive case studies to reinforce what you learn. The instructors, who have experience working at prominent companies like PwC and Coca-Cola, provide excellent support and feedback. The course also offers a 30-day unconditional money-back guarantee.

This course is an excellent choice for anyone looking to become a successful financial analyst.

Who Is This Course For?

This course, The Complete Financial Analyst Course, is designed for anyone interested in starting a career in finance or for those looking to enhance their financial analysis skills. It is suitable for beginners and intermediate users of Microsoft Excel and PowerPoint. The course covers fundamental topics such as accounting, cash flow statement analysis, financial math, business analysis, and capital budgeting. Whether you’re a recent graduate, a business professional, or an entrepreneur looking to gain a deeper understanding of financial analysis, this course can benefit you.

What Are The Features & Course Content?

The Complete Financial Analyst Course is a comprehensive online course designed to equip learners with the skills and knowledge needed to become successful financial analyst. Here are some of the features and course content:

Course Content:

- Quick Introduction

- Microsoft Excel

- Modeling in Excel

- Accounting

- Advanced Accounting

- Financial Statement Analysis

- Working Capital Management

- Fundamentals of Business and Financial Analysis

- Capital Budgeting

What’s the Duration And Price?

The duration of the course is 19.5 hours of on-demand video. The current course price is $34.99, but prices may vary depending on promotions and discounts offered by Udemy.

Pros & Cons: Is It Worth Spending?

Suppose someone is looking for a comprehensive course that covers finance fundamentals and provides practical skills and knowledge directly applicable to a career as a financial analyst. In that case, this course may be a good fit.

Pros:

- The course provides a comprehensive overview of financial analysis, including accounting, financial statement analysis, working capital management, and capital budgeting.

- Experienced instructors teach the course with a background in finance, and the content is well-organized and easy to follow.

- The course includes practical exercises and case studies that allow learners to apply concepts they have learned in the real world.

- The course is relatively affordable at $34.99, and Udemy frequently offers discounts and promotions that make it even more accessible.

- The course is flexible and can be accessed online from anywhere with an internet connection, allowing learners to study at their own pace and on their schedule.

Cons:

- The course is relatively long, 19.5 hours, and may require a significant time commitment from learners.

- The course focuses on financial analysis and may not provide a comprehensive overview of other financial topics, such as finance or investment banking.

What Are People Saying – Customer Reviews?

The Complete Financial Analyst Course” on Udemy is an excellent investment for anyone looking to improve their financial analysis skills. The course covers various topics, from Excel modeling to financial statement analysis. The instructors are knowledgeable and engaging, and the on-demand videos make it easy to learn at your own pace. Overall, highly recommended for aspiring financial analysts.

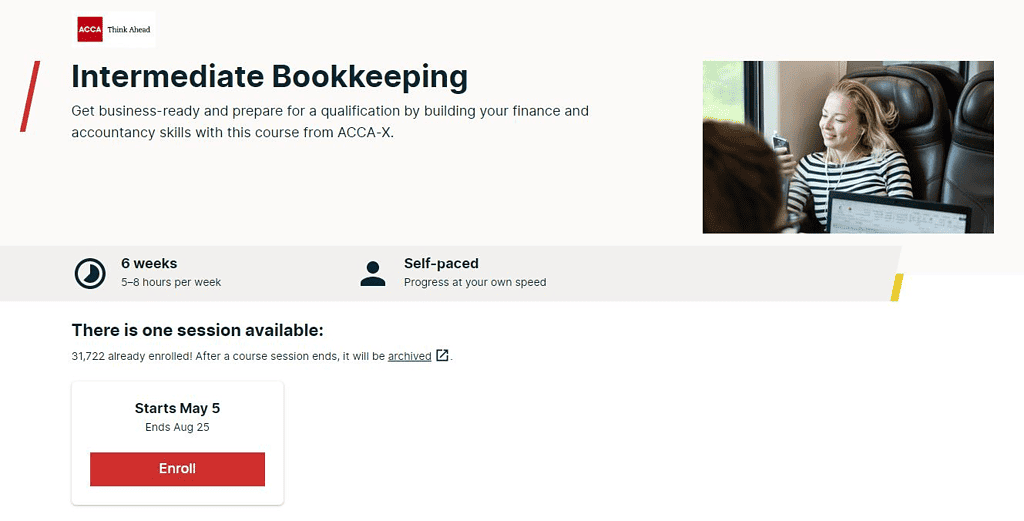

Intermediate Bookkeeping

The Intermediate Bookkeeping course on edX is designed to help learners build their finance and accountancy skills and prepare for qualification. ACCA-X offers the course and is ideal for those who have completed the Introduction to Bookkeeping course or have prior bookkeeping knowledge.

The course covers basic financial statements, preparation of accounts, principles, and concepts relating to maintaining financial records, and more.

The course includes detailed syllabus guides and is updated to align with ACCA syllabus changes. While the course does not offer an edX certificate, learners can earn a certificate by sitting the relevant ACCA exam.

Who Is This Course For?

This course is designed for individuals who have completed the Introduction to Bookkeeping course or have prior knowledge of bookkeeping and are looking to further their understanding of financial accounting. It is also beneficial for those who want to prepare for the ACCA’s exam in Maintaining Financial Records (FA2) or gain the knowledge to undertake a role as an accounting administrator or bookkeeper.

What Are The Features & Course Content?

The “Intermediate Bookkeeping” course offered by ACCA-X through edX covers the following features and course content:

- Generally accepted accounting principles and concepts

- The Principles and Process of Bookkeeping

- Preparation of journal entries

- Recording transactions and events

- Preparing the trial balance and correcting errors

- Extending the trial balance

- Accounting for partnerships

Through these topics, learners will gain a deeper understanding of bookkeeping and accounting principles and processes and the ability to prepare financial statements and maintain accurate financial records. This course is ideal for those who want to explore the preparation of financial statements, gain knowledge of accounting administrator/bookkeeper roles, and understand the principles and concepts related to maintaining financial records.

What’s the Duration And Price?

According to the edX website, the “Intermediate Bookkeeping” course is a self-paced course that takes approximately five to six hours per week to complete over six weeks. The course is free to audit, meaning you can access all the course materials and lectures for free, but you will not receive a certificate upon completion. However, if you want to earn a verified certificate to demonstrate your course completion, there is a fee of $249.

Pros & Cons: Is It Worth Spending?

If someone seeks to prepare for the ACCA’s FA2 exam or gain practical bookkeeping skills, the course may be a good fit. However, if someone is seeking a more comprehensive and formalized education in accounting and finance, they may need to look into additional courses or degree programs.

Pros:

- The course provides a comprehensive overview of the principles and process of bookkeeping and generally accepted accounting principles and concepts.

- Learners will gain practical skills in recording transactions, preparing financial statements, and correcting errors.

- The course offers flexible learning with a 6-week timeline and the ability to complete 5-8 hours of coursework per week.

- Learners have access to detailed syllabus guides and support from the ACCA community.

- The course is offered by ACCA-X, the online learning platform of the Association of Chartered Certified Accountants (ACCA), a reputable professional organization for accountants.

Cons:

- The course does not offer an edX certificate, which may be a drawback for learners seeking formal recognition of their skills.

- The course may be more focused on preparing learners for the ACCA’s Maintaining Financial Records (FA2) exam rather than providing a broad understanding of bookkeeping and accounting principles.

What Are People Saying – Customer Reviews?

The “Intermediate Bookkeeping” course by ACCA-X is a great way to build upon your foundational knowledge of bookkeeping and prepare for a career in accounting or finance.

The course covers various topics, including financial statements, accounting principles and concepts, and maintaining financial records.

With flexible learning options and a focus on practical skills, this course suits anyone looking to expand their knowledge base and gain a deeper understanding of bookkeeping.

Overall, the “Intermediate Bookkeeping” course is a valuable investment for anyone interested in pursuing a career in accounting or finance.

Financial Statement Analysis

The “Financial Statement Analysis” course offered by Intuit Bookkeeping Professional Certificate is an excellent opportunity for learners to apply their foundational accounting concepts to financial statement analysis.

This course provides learners with the skills to reconcile different types of accounts, apply various analytical methods to financial statements, and understand how these methods can inform different business decisions.

Upon completion, learners will earn a shareable certificate and be equipped with the skills to analyze business health. While previous courses are recommended prerequisites, learners can complete them at their own pace with flexible deadlines.

Who Is This Course For?

This course is ideal for individuals who have a foundational understanding of accounting and are interested in applying their skills to financial statement analysis. It is also suitable for professionals looking to advance their knowledge in this area and make data-driven business decisions. Prior completion of Courses 1-3 in the Intuit Bookkeeping Professional Certificate or equivalent is recommended.

What Are The Features & Course Content?

The “Financial Statement Analysis” course on Coursera is part of the Intuit Bookkeeping Professional Certificate and is designed for learners with a foundational understanding of accounting concepts. This course covers topics such as:

- Understanding Reconciliations

- How to Read Financial Statements

- Analyzing Key Reports and Transactions

- Application and Practice with Reconciliations and Financial Analysis

The course features flexible deadlines, allowing learners to complete it at their own pace. It also includes interactive exercises, quizzes, and case studies to reinforce learning. Upon completion of the course, learners can earn a shareable certificate.

What’s the Duration And Price?

The course “Financial Statement Analysis” is approximately 18 hours and is available on Coursera as part of the Intuit Bookkeeping Professional Certificate. This certificate program costs $49 per month to continue learning after the trial ends. However, learners can audit the course for free without earning a certificate.

Pros & Cons: Is It Worth Spending?

Suppose you seek to apply your foundational accounting skills to financial statement analysis and gain practical knowledge in this area. The “Financial Statement Analysis” course may be a valuable investment in that case.

Pros:

- The course provides learners with practical skills to analyze and interpret financial statements.

- Learners will gain an understanding of basic financial statement analytical methods and how to apply quantitative skills to analyze business health.

- Flexible deadlines allow learners to complete the course at their own pace.

- Upon completion, the course offers a shareable certificate to showcase newly acquired skills to potential employers.

- The course is taught by industry experts from Intuit Academy, ensuring learners gain knowledge from experienced professionals.

Cons:

- The course is only recommended for learners who have completed the preceding Intuit Bookkeeping Professional Certificate program courses. It may not be suitable for those without a foundational understanding of accounting.

- While the course offers practical skills, it may not provide a comprehensive education in accounting and finance. Learners seeking a more formalized education may need to look into additional courses or degree programs.

What Are People Saying – Customer Reviews?

“Financial Statement Analysis” is a highly informative course that provides a comprehensive understanding of financial statements and their role in decision-making. The course is well-structured and covers topics such as bank reconciliation, financial statement analysis, and quantitative analysis of business health. The course offers flexible deadlines and is taught by experts in the field. Overall, it is a great choice for anyone looking to enhance their financial analysis skills.

Frequently Answered Questions

What are the best finance courses available online?

Numerous finance courses are available online, and the best ones depend on individual preferences and career goals. Some popular options include courses from top business schools like Wharton and Harvard and courses from specialized providers like Coursera and Udemy.

How long do online finance courses typically take to complete?

The duration of online finance courses can vary widely depending on the course provider and the level of depth covered. Some courses can be completed in just a few hours, while others may require several weeks or months of study.

Do employers recognize online finance courses?

Many online finance courses are recognized by employers, particularly those offered by well-respected institutions like Wharton and Harvard. However, it’s always important to research a course’s reputation and credibility before enrolling.

Do online finance courses require any prerequisites?

This varies depending on the course. Some introductory courses may not have any prerequisites, while more advanced courses may require certain knowledge or experience in finance or related fields.

What are the costs associated with online finance courses?

The costs of online finance courses can vary widely depending on the provider, the level of the course, and the amount of content covered. Some offer free online class, while others cost hundreds or even thousands of dollars. It’s important to research the costs and value of a course before committing to it.

What is the role of university professors in providing free online classes on personal finance?

University professors often offer free online class on personal finance that can provide valuable insights and tips for managing your money. Alternatively, you can consult a chief financial officer for personalized advice on financial planning and investment strategies.

Conclusion:

In conclusion, a wide range of finance courses are available online, catering to different skill levels and interests. Whether you seek to advance your career, enhance your financial literacy, or gain new skills, there is a course for you. From prestigious universities to industry experts, the instructors of these courses bring a wealth of knowledge and experience to the table. With the convenience of online learning and the flexibility to fit coursework into your schedule, taking a finance course has never been easier. So take the first step towards achieving your financial goals by enrolling in one of today’s best finance courses online.

Richa Sharma is a research content writer for over 10 years. She has a vast amount of experience in many different industries and has written for both small and large companies. Her specialty is creating compelling, engaging, and informative content that engages the reader and drives conversions. When it comes to writing, she has a knack for taking complex topics and making them easy to understand for the average reader. We are Excited to have Richa onboard with us here at https://financialnomads.com