Best Small Business Payroll Services of 2023: A Comprehensive Review

Starting a small business can be a thrilling experience. However, running a successful small business comes with a lot of responsibilities. One of the key aspects of any business, whether small or big, is ensuring that your employees get paid on time and accurately. Managing payroll alone can be challenging for small business owners, especially when they need more time and resources. That’s where small business payroll software services come in handy.

These services can help you streamline your payroll process, ensure compliance with tax regulations, and save time and money. An Internal Revenue Service (IRS) survey indicates that 40% of small businesses pay around $845 in penalties for incorrect filing, depositing incorrect withholdings, or failing to deposit withholdings – so picking a payroll service can make your business run more smoothly in many ways.

With so many options, how do you pick the right payroll provider for your company? In this article, we will explore some of the best small business payroll services available, comparing their features, pricing, and customer reviews to help you make an informed decision.

Quickbooks

QuickBooks Payroll is the best payroll software designed for small businesses with up to 150 employees or. It offers various features that simplify payroll management, including automatic payroll runs, direct deposit, tax calculation and filing. Integrates with QuickBooks Online, ensuring accounting records are auto updated.

ZOHO

Zoho Payroll is a cloud-based payroll management software for small and medium-sized businesses. It streamlines the payroll process by automating tasks like generating pay slips, calculating taxes, and managing employee data. Zoho also ensures compliance with tax laws and regulations, minimizing the risk of errors and penalties.

Gusto

Gusto is a business management tool designed specifically for small businesses and is particularly useful for hospitality businesses due to its resources and tools for tracking varying wages and tips. In addition, Gusto assists new users with the payroll setup process, so you can get up and running as soon as possible.

Why do small businesses need payroll services?

Small businesses need payroll services for several reasons. Payroll is an essential function for any business that employs staff, and it involves more than just calculating employee wages. Here are some reasons why small businesses need payroll services:

Time-saving: Payroll processing can be time-consuming, and small business owners often need more time and resources. Outsourcing payroll to a payroll service provider can save small business owners valuable time that they can use to focus on other areas of their business.

Compliance: Payroll is heavily regulated, and small businesses must comply with state and federal laws. Payroll service providers stay up-to-date with the latest regulations and can help ensure small businesses remain compliant.

Accuracy: Payroll calculations can be complex, and errors can result in costly fines and penalties. A payroll service provider has the expertise and technology to ensure payroll calculations are accurate and taxes are filed on time.

Employee satisfaction: Employees expect to be paid accurately and on time. A payroll service provider can help ensure timely and accurate payment of salaries and wages, leading to higher employee satisfaction and productivity.

Cost-effective: While some small business owners may think that they can save money by handling payroll in-house, it can be more cost-effective to outsource payroll to a service provider. A payroll service provider can help small businesses avoid costly mistakes, such as errors in payroll calculations, missed tax payments, and non-compliance with regulations.

What to look for in the best payroll services for small businesses?

When choosing the best payroll service for your small business, it’s essential to consider several factors to ensure that you find the right fit. When choosing a payroll service, keep these things in mind:

- Features offered: Look for a payroll service that provides the features you need, such as automatic tax filing, direct deposit, and employee self-service. Consider whether you need additional features, such as benefits administration or time tracking.

- Ease of use: A payroll service should be easy to use, even if you don’t have a background in accounting or payroll. Look for a service with a user-friendly interface and helpful customer support.

- Affordability: Payroll services can vary widely in price, so it’s important to consider your budget when choosing a provider. Look for a service with transparent pricing and no hidden fees.

- Access to benefits management: Many payroll services, such as health insurance and retirement plans, offer benefit management. If you’re interested in offering benefits to your employees, look for a service that provides access to these benefits.

- Compliance: Ensure the payroll service you choose complies with all relevant laws and regulations, including tax and labor laws. Look for a service that stays up-to-date with changes in regulations and has a track record of compliance.

- Customer support: Payroll can be complex, so choosing a service that offers helpful customer support is important. Look for a service with responsive customer support, including phone and email support and online resources like FAQs and video tutorials.

By considering these factors when choosing a payroll service for your small business, you can find a provider that meets your needs and helps you manage payroll more efficiently.

Top 9 best small business payroll services

Many payroll services are available for small businesses, each with its own features and pricing structures. Here are some of the best small business payroll services available online:

Quickbooks Payroll

QuickBooks Payroll is the best payroll software designed for small businesses with up to 150 employees or contractors. It offers various features that simplify payroll management, including automatic payroll runs, direct deposit, and tax calculation and filing. The software seamlessly integrates with QuickBooks Online, ensuring accounting records are automatically updated alongside payroll, eliminating the need for manual data entry.

One of the standout features of intuit QuickBooks Payroll is its ability to accommodate businesses as they grow. With three plan offerings, payroll companies can upgrade to access more services as needed. The Elite plan includes geofencing and a callback option to minimize wait times, while the Premium plan comes with an expert review to ensure the setup is error-free.

QuickBooks Payroll also partners with Simply Insured and Guideline to offer health benefits and retirement plans. The Workforce portal allows employees to access their pay stubs securely, W-2s, paid time-off balances, and bank information for direct deposit. The software offers same-day or next-day direct deposits, providing a quick turnaround time ideal for cash-flow management.

Additionally, all plans come with 24/7 chat and phone support during extended hours to assist when needed. Overall, QuickBooks Payroll is an intuitive, user-friendly payroll solution that simplifies the payroll process for small businesses, making it an excellent choice for businesses that already use QuickBooks Online.

Why do we like it?

- Payroll Tax Calculations and Filings: QuickBooks Payroll automatically calculates, files, and pays federal and state payroll taxes for all three plan tiers, including year-end filings. The Premium and Elite plan also handle local payroll taxes.

- Direct Deposits: Free next-day direct deposit is available in the Core plan, while the Premium and Elite plan offers employees free same-day direct deposit.

- Automated Payroll: QuickBooks Payroll can automatically run payroll for salaried employees paid via direct deposit and hourly employees with default hours paid via direct deposit.

- QuickBooks Time: QuickBooks Payroll Premium and Elite plan come with QuickBooks Time, which lets employees clock in and out on their smartphones. The Elite plan also includes a geofencing feature for job costing purposes.

- Accuracy Guarantee: All QuickBooks Payroll plans come with an accuracy guarantee. The Elite plan covers up to $25,000 per year in payroll tax penalties resulting from mistakes an employer might have made.

- Support: QuickBooks Payroll provides 24/7 chat and phone support from 6 a.m. to 6 p.m. PT Monday through Friday and 6 a.m. to 3 p.m. PT on Saturday. The Elite plan also includes a callback option to minimize wait times.

- Integration with QuickBooks Online: QuickBooks Payroll integrates directly with QuickBooks Online, and accounting records are automatically updated alongside payroll.

Price:

- Simple Start: $8.50 per month

- Essentials: $13 per month

- Plus: $18 per month

Pros:

- Seamless integration with QuickBooks Online Accounting

- The easy onboarding process for new employees

- Unlimited payroll runs and direct deposit capability.

- Employee portal for accessing pay stubs and tax forms

- Mobile app for iOS and Android devices

- HR features available in Premium and Elite plans

Cons:

- Limited to 50 employees

- Limited HR payroll features in lower-tier plans.

- Additional fees for tax filings and W-2 processing

Best for:

Small businesses with 15 employees or less need payroll software.

User Review:

QuickBooks Online Payroll is a great payroll application. The onboarding process was easy, and I could get up and running quickly. The application is easy to use, and the customer support is excellent. I recommend this application to anyone looking for a great payroll solution.

Onpay

The OnPay platform enables the small business owner to spend more time running their company (rather than handling back-office duties). Businesses can save up to 15 hours monthly using its award-winning payroll and HR services. OnPay provides small businesses and startups with an easy-to-use payroll solution. You can pay your employees by direct deposit or by check. The software offers several features that benefit businesses that run payroll weekly or pay contractors regularly, such as the ability to run payroll as often as necessary.

OnPay software allows employers to manage payroll, add employees to payrolls, set employee statuses, run payrolls, and manage paid time off (PTO). The platform includes payroll tax preparation, payroll tax withholding, and benefits deductions. Your company covers the fine if you make an error with your filings or payments.

The OnPay HR tool suite comes with everything your business needs for only $40 per month plus $6 per employee. The freelancers you pay are counted as employees under this model, so you’ll be charged for their 1099s.

Users can now create custom expense reports with OnPay’s reporting upgrade in 2021. There are several key features in a key report, including the ability to add up to 50 data points. In addition, you can reorder columns to emphasize important information and save multiple views of the report for different stakeholders. It helps you keep track of your business finances and make informed decisions.

Why do we like it?

- Streamline Payroll Processing: OnPay handles all payroll processing tasks, including calculating wages, taxes, and deductions and generating pay stubs for each employee.

- Tax Calculations: OnPay automatically calculates taxes for payroll, including federal, state, and local taxes, Federal Insurance Contributions Act (FICA), Medicare, and Social Security taxes. This software ensures small business owners comply with all tax rules and regulations.

- Payment Options: The software offers flexible payment options like direct deposit, checks, and prepaid debit cards. Small business owners can choose the best payment method for each employee.

- Benefits Administration: OnPay allows small business owners to automate deductions for benefits like health insurance, retirement plans, and other employee benefits. This functionality eliminates manual calculations, making the payroll process much more efficient.

- Time Tracking and Reporting: OnPay facilitates time tracking and reporting whereby employees can log in and out of work, track hours, and request time off. Small business owners can track employee time and use this information to calculate payroll accurately.

- Compliance: OnPay guarantees compliance with all federal, state, and local payroll tax laws. The software automatically fills out and files the necessary forms with the appropriate authorities.

- Customer Support: OnPay provides customer support through phone and email during business hours. Small business owners can trust that their queries will be answered promptly to avoid delays in payroll processing.

Price:

- Base Fee: $40 per month

- Per person: $6 per month

Pros:

- Simple and easy-to-use platform designed for small businesses.

- Affordable one-size-fits-all pricing plan.

- Unlimited payroll runs per month.

- Calculates pay based on pay rate and hours worked, withholding proper taxes and deductions.

- It Offers several payment options, including direct deposit, paper check, and prepaid debit card. Automatically calculates payroll taxes and files required forms.

- It Generates customizable payroll reports.

- It Offers excellent customer support.

Cons:

- It may not be suitable for larger businesses with complex payroll needs

- Limited customization options

- Only supports US-based businesses

Best for:

Small businesses seek an affordable and comprehensive payroll software solution that handles all payroll needs, including tax calculations and filings.

User Review:

OnPay is a fantastic payroll software for small businesses! It’s affordable, easy to use, and efficient. I’ve been using it for the last five months, making payroll a breeze. The reports are thorough, and the payment options are great. I recommend OnPay to any small business!

Gusto

Gusto is a business management tool designed specifically for small businesses and is particularly useful for hospitality businesses due to its resources and tools for tracking varying wages and tips. In addition, Gusto assists new users with the payroll setup process, so you can get up and running as soon as possible.

A Gusto payroll system is easy to navigate, provides new hire reporting, is flexible, enables unlimited payroll runs, supports contractor payments, and supports multi-state payroll. With Gusto, you don’t need a mobile app to use it.

In addition, the application includes tax reporting and remittance, employee onboarding, and tax reporting. Gusto offers HR resources too, but only in their most expensive plan. With Gusto’s AutoPilot feature, you can track the wages of a high number of salaried employees, and you can integrate with a lot of third-party apps.

Gusto offers four plans: Basic, Core, Complete, and Concierge, designed for companies with suitable employees. Basic is good for small companies, Core is good for small businesses growing, and Complete is great for businesses with many employees.

Why do we like it?

- Onboarding: Gusto helps to streamline new employee onboarding by providing customizable offer letters, digital sign-off, and task assignments to ensure new hires have a smooth transition into the company.

- Payroll Processing: Full-service payroll processing with automated tax calculations, direct deposit, paper checks, and payroll tax filings. It automatically calculates tax withholdings and takes care of any necessary deductions.

- Benefits Administration: Gusto manages a company’s employee benefits, such as health insurance, 401(k), and commuter benefits, and offers support to help employees understand and maximize their benefits.

- Compliance: Gusto stays up-to-date with changing regulations and offers compliance support to ensure that a company stays in line with federal and state laws.

- Time Off Management: Employers can use Gusto’s time-off management tool to approve requests and track employee PTO, sick days, and other types of leave.

- HR Document Management: Gusto helps to digitize and centralize employee records, such as tax forms and contracts, in one place for easy access by HR and management teams.

- Mobile App: Convenient mobile access to key HR and payroll functions, allowing employers to manage their workforce from anywhere.

Price:

- Simple: $40/mo (plus $6/mo per person)

- Plus: $60/mo ($9/mo per person)

- Premium: Exclusive pricing

Pros:

- User-friendly and easy-to-use interface.

- Comprehensive HR services and tools.

- Expert guidance and support from HR professionals.

- Access to pay stubs and tax documents for both employees and employers.

- It Provides benefits management services.

- Efficient and streamlined HR processes.

- Great customer support.

Cons:

- Gusto focuses on small companies.

- Gusto tracks PTO but does not keep track of time

- ATS and performance management are not available in Gusto

Best for:

Small businesses seek an all-in-one HR platform to manage employee onboarding, payroll, benefits, and engagement.

User Review:

I’ve used Gusto for both my business and my payroll. The customer service is excellent, and they are always happy to help with anything you need. The process is straightforward to use, and I’ve found that their rates are very competitive. Highly recommend it!

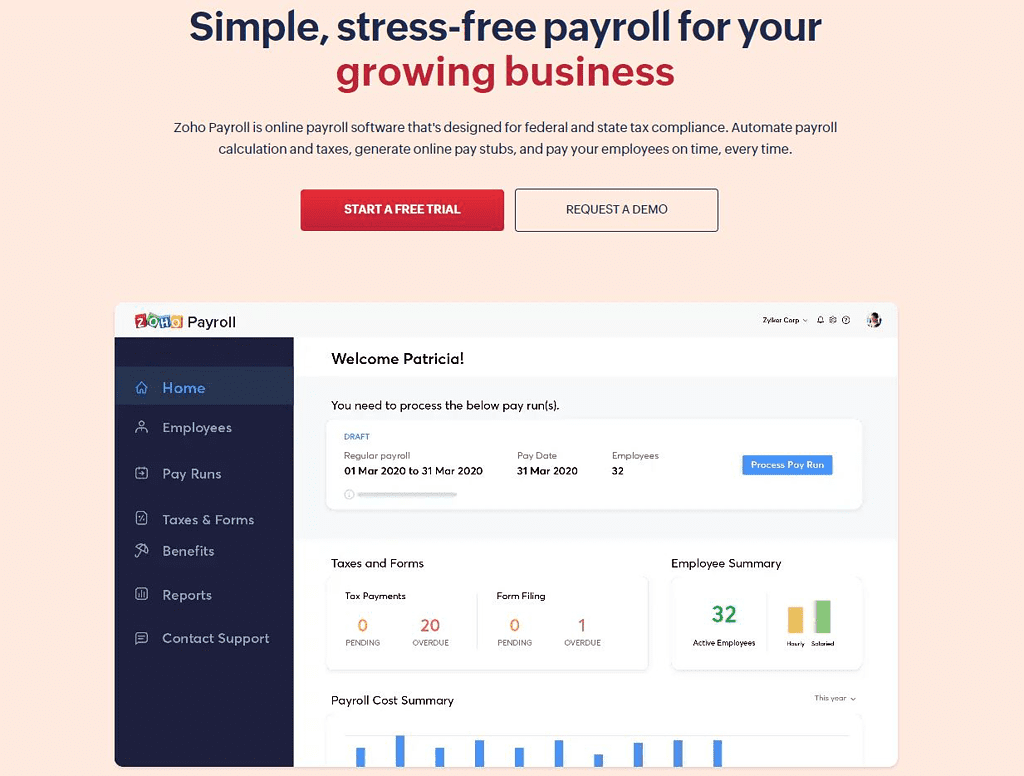

Zoho Payroll

Zoho Payroll is a cloud-based payroll management software for small and medium-sized businesses. It streamlines the payroll process by automating tasks like generating payslips, calculating taxes, and managing employee data. Zoho Payroll also ensures compliance with tax laws and regulations, minimizing the risk of errors and penalties.

One of the key features of Zoho Payroll is its ability to automate payroll calculations based on employee attendance, leave records, and other factors. It also generates detailed reports on payroll expenses, tax liabilities, and other relevant metrics.

Zoho Payroll also integrates with other apps like Zoho Books and Zoho People, allowing for a more comprehensive and streamlined HR and payroll management experience.

Other notable features of Zoho Payroll include support for multiple payment modes, including direct deposits, checks, and cash; employee self-service portals for viewing payslips and other information; and an intuitive user interface that makes the payroll process easy.

Overall, Zoho Payroll is a powerful and reliable payroll management solution that can save businesses time, money, and effort. It offers many features and integrations, making it a versatile tool for managing payroll and HR tasks.

Key Features:

1. Automated Payroll Processing: Zoho Payroll software automates payroll processing, including salary calculations, tax deductions, and employee reimbursements, making it easier to manage and process payroll accurately.

2. Tax Compliance: The software automatically calculates and deducts taxes based on applicable tax laws and regulations, ensuring that your payroll always complies with the law.

3. Employee Self-Service Portal: Zoho Payroll has a self-service portal allowing employees to access their payslips, tax statements, and other payroll-related information. This reduces the workload on HR and improves employee satisfaction.

4. Integration with Other Zoho Products: Zoho Payroll can be integrated with other Zoho products, such as Zoho Books and Zoho People, enabling seamless data flow between these applications.

5. Customizable Reports: The software offers customizable reports that can provide insights into payroll data, including salary payments, tax liabilities, and reimbursements. This helps businesses to identify trends and make informed decisions.

User Experience:

As a small business owner, I was looking for payroll software to handle all my payroll tasks, from calculating taxes to generating pay stubs. Zoho Payroll was recommended to me by a friend, and after using it for a few months, I can confidently say that it has exceeded my expectations. One of the best features of Zoho Payroll is its simplicity. I was able to set up my account in just a few minutes, and the user interface is very intuitive. I also appreciate that Zoho Payroll offers a variety of payment options for employees, including direct deposit and paper checks.

Another feature that I find extremely helpful is the automatic tax calculations. Zoho Payroll takes care of all the tax calculations for me, which has saved me a lot of time and headaches. I no longer have to worry about whether I am calculating taxes correctly or keeping up with tax rate changes. Zoho Payroll also generates and files all the necessary tax forms on my behalf.

One area where Zoho Payroll could improve is its customer support. While I have not had any major issues with the software, there have been times when I had questions or needed help with a feature, and it was difficult to find the information I needed. The customer support team is responsive, but I wish more resources were available online, such as video tutorials or a comprehensive knowledge base.

Overall, Zoho Payroll has been a great investment for my business, and I would highly recommend it to other small business owners.

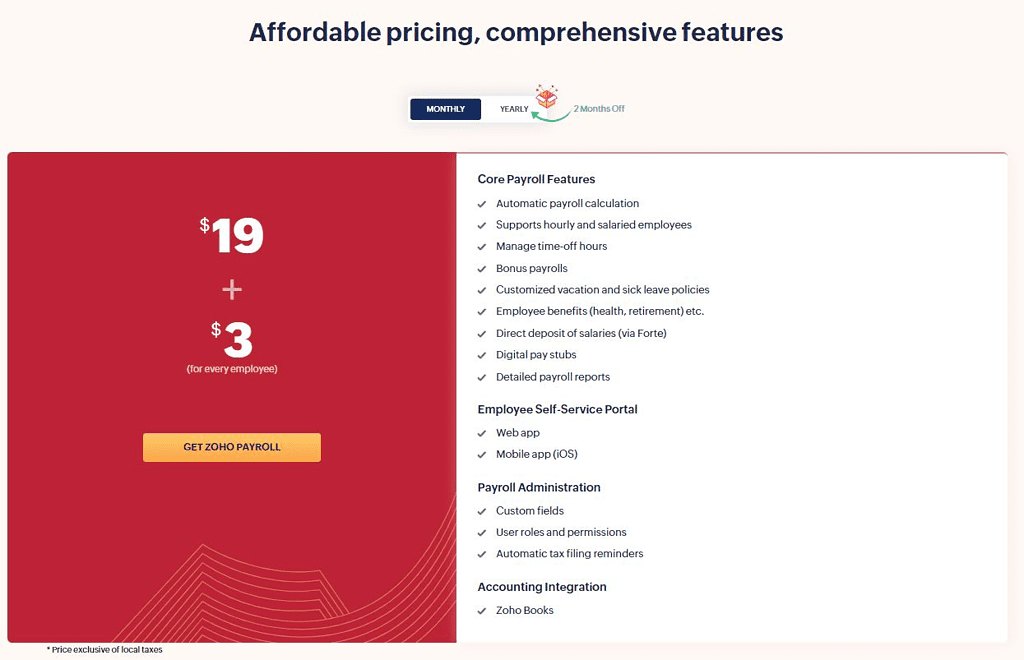

Pricing:

Zoho Payroll offers two pricing plans:

- Monthly – $19 per month

- Yearly Plan – $190 per year

Pros:

1. User-Friendly Interface: Zoho Payroll has a clean and intuitive interface that makes it easy to navigate and use.

2. Automatic Calculations: The software automatically calculates taxes, deductions, and other payroll-related calculations, which saves time and reduces the risk of errors.

3. Compliance: Zoho Payroll complies with local labor laws and regulations, ensuring you stay compliant with all necessary regulations.

4. Integration with Zoho Suite: Zoho Payroll integrates seamlessly with other Zoho Suite applications, such as Zoho Books and Zoho CRM, for streamlined payroll management.

5. Reports and Analytics: Zoho Payroll provides a range of reports and analytics that help you gain insights into your payroll data, such as salary reports, tax reports, and more.

Cons:

1. Limited Customization: Zoho Payroll’s customization options are limited, which may not be ideal for companies with complex payroll needs.

2. Limited Availability: Zoho Payroll is unavailable in all countries, which may limit its usefulness for some businesses with global operations.

Product Reviews:

Patriot

Patriot Payroll is not as popular as some other payroll applications highlighted here, but they have many of the same features. The Patriot Payroll software offers two plans for small businesses, both of which offer free direct deposits, employee portals, and payroll setup for free.

Using Patriot Payroll from Patriot Software, you can streamline processes such as payroll payments and tax submissions that help with human resources (HR) and payroll management. The solution allows for the management of payroll records, the printing of checks, the setting up of direct deposits into bank accounts, the generation of payroll reports, and the submission of federal and state taxes.

The Patriot Payroll system offers direct deposits and electronic checks for issuing payrolls. Employees can access their payroll and financial information through a personalized portal using the software. Employees can create year-end reports and produce W2 forms utilizing the application’s reporting functionality.

The Patriot Payroll solution is an independent payroll solution that you can also integrate with Patriot TIME (time and attendance) and Patriot HR (personnel tracking) for a fully integrated Human Resource Management (HRM) solution. Our payroll solution is ideal for businesses with one and a hundred employees and serves customers in various industries, including distribution, engineering, maintenance, retail, and field service.

Why do we like it?

- Payroll processing: It automates payroll calculations, generates pay stubs, and allows payment via direct deposit or printed checks.

- Direct Deposit: The software enables you to create direct deposits for employees, which is a fast, secure, and convenient way to transfer funds directly to bank accounts.

- Reporting: Patriot Payroll’s reporting capabilities offer insights into payroll expenses and the data necessary for creating budgets and measuring productivity.

- Time and Attendance: The solution captures time data, integrates with other Patriot Software solutions, and permits employees to log in on time via mobile devices.

- Employee Portal: The portal comprises detailed pay stubs, tax forms, and other pertinent information employees may need.

- HR Compliance: Patriot Payroll helps with HR compliance by providing all payroll reports to assist in creating reports mandated under the law.

- HR Integration: It integrates with other Patriot Software products, such as Patriot HR and Patriot TIME, to provide a comprehensive HR and payroll management solution.

- Multi-state Capabilities: The solution is ideal for organizations that want to manage payroll for employees operating in different states as it manages payroll taxes in other regions.

Price:

- Free: $0 (30 days free trial)

- Basic Payroll: $17 per month (+$4 per employee/contractor)

- Full Service Payroll: $37 per month (+$4 per employee/contractor)

Pros:

- Easy-to-use interface with step-by-step guidance

- Affordable pricing and flexible plans

- Ability to process payroll for both salaried and hourly employees

- Offers direct deposit and electronic cheque options for payments

- Can generate detailed payroll reports and tax filings seamlessly

- Employee self-service portal for accessing payroll information

- A strong customer support team is available via phone, email, and chat.

Cons:

- Services like HR integration, support, and timekeeping are separate fees.

- It is more expensive to use Full-Service Payroll for filing and depositing taxes.

Best for:

Small and medium-sized businesses seek an affordable and user-friendly payroll and HR solution.

User Review:

I love Patriot Payroll! The software is easy to use and helps streamline the payroll process. The direct deposit feature is a lifesaver, and the reports are fantastic. I recommend this software to anyone looking for an easy way to manage their payroll payments and tax submissions.

Paychex

Paychex is the ideal online payroll service for businesses of every size. Your paycheck can come every week, every biweekly, every semimonthly, or every month. It can handle full-time employees, part-timers, and 1099 contractors. Payrolls can be deposited directly into your account, mailed, or sent to a prepaid debit card.

Paychex is a payroll and human resources (HR) solution that offers benefits administration (BA) and can be subscribed to for payroll services only. It is a scalable solution that is suitable for companies poised to grow. It is also the most expensive solution reviewed, with fees starting at $60 per pay period.

Paychex offers comprehensive support, including 24/7 live phone support, and assigns a payroll specialist as the primary contact. The payroll processing is flexible and more customizable than competitors, with the option to define unlimited custom fields. The site also offers extras, such as the ability to work ahead on payrolls and automatically run specified reports after a payroll run.

Employees can view current and historical pay stubs and request time off by logging into their portal, while employers can view employee records and reports through their app. Paychex has a professional and clean user interface that is easy to navigate.

Why do we like it?

- Automatic payroll: Paychex Flex handles all payroll tax calculations and payments, including federal, state, and local taxes. The system also automatically files tax forms and reports to the appropriate agencies.

- Time and attendance management: Employees can use Paychex Flex to quickly and easily record their time and attendance, which their supervisors can approve. The system can also track accruals, such as vacation and sick time.

- Benefits administration: Users can manage benefits enrollment, view and update employee benefits information, and access benefit summaries and plan documents.

- Reporting and analytics tools: Paychex Flex offers more than 160 standard reports, dashboards, and fully customizable and configurable reports to help users make informed decisions.

- Mobile accessibility: Paychex Flex is accessible from any desktop or mobile device via single sign-on, making it easy for users to manage payroll and HR tasks.

- Employee self-service: Employees can access their paystubs, retirement account balances, and benefits information through Paychex Flex, as well as update their personal data and tax withholding status.

- Compliance support: Paychex Flex provides guidance and support to help users comply with federal and state payroll and tax laws and ACA reporting requirements.

Price:

- Paychex Flex® Essentials: $39 per month + $5 per Employee

- Paychex Flex® Select: Get a Quote

- Paychex Flex® Pro: Get a Quote

Pros:

- The cloud-based platform is accessible from any device.

- Automated payroll tax calculation, payment, and filing.

- Time and attendance tracking for employees.

- Reporting and analytics tools for informed decision-making.

- Centralized access to policies, procedures, documents, and paystubs.

- Customizable and configurable reports.

- 24/7 U.S.-based support and dedicated HR professional option.

Cons:

- Some advanced features may require additional fees.

- Limited customization options for certain features.

- It may be suitable for something other than tiny businesses.

Best for:

Small to mid-sized businesses looking for a comprehensive payroll management system with easy-to-use tools for employees and customizable reporting options.

User Review:

I like that I can access Paychex Flex from anywhere. I can punch in and out from my phone, which is helpful since I’m always on the go. And the reports are so helpful, especially since I’m not very good with numbers. I don’t have to worry about perfecting everything because the Paychex Flex system does all of the calculations for me.

Roll

Roll by ADP is a mobile payroll app that offers a simple and elegant solution for small businesses with basic payroll needs. With its advanced artificial intelligence, Roll allows you to run payroll and hire employees with simple, chat-based commands. The chatbot-like virtual assistant guides you through creating a payroll, from completing your company profile to adding employees and sending out the paychecks.

It offers unlimited pay runs and multiple pay schedules, allowing you to run payroll anytime without additional charges. The app supports direct deposits and company checks and offers several earning types, including hourly contracts, overtime fees, flat fees, holiday premiums, performance bonuses, and business expenses. You can also make one-time payments to employees.

It is also an excellent tool for employees, who can log into the app to manage their pay data, download pay data, and set up their profiles. The app lets you set up deductions and contributions for medical, vision, and dental insurance for employees and create Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA).

It can easily run, pay, and file payroll taxes for your organization. The process of filing your taxes on your behalf is completely automated if you grant consent to ADP and assign ADP limited power of attorney. Overall, it is an easy-to-use payroll app that lets you compensate employees quickly without worrying about extensive setup or complex reports.

Why do we like it?

- Chat-based Interface: Allows for easy setup of employee profiles, running payrolls, and filing taxes using simple text commands.

- AI-powered virtual assistant: Guides users through the entire process of creating a payroll, from completing company profiles to adding employees to sending out paychecks.

- Employee Profile Management: The app allows users to easily add and manage employee profiles by guiding them through completing the company profile, adding employees, and sending out paychecks.

- Unlimited Pay Runs: Users can run unlimited payrolls with multiple pay schedules and even set up off-cycle payrolls to offer employee bonuses.

- Automatic Tax Filing: Roll by ADP automates the payroll tax filing process for the organization once granted consent and limited power of attorney to ADP to file taxes on the company’s behalf.

- Benefits Administration: Users can set up and manage employee deductions and contributions for medical, vision, and dental insurance, as well as create Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) for employees.

- Payment Remittance: The app supports direct deposits and company checks and allows users to add applicable premiums and bonuses when choosing the payment method for the pay run.

- Integration: Currently does not integrate directly with any third-party accounting software, but a Quickbooks integration is in the works.

- Mobile App: Roll by ADP is a mobile-based app that can be downloaded on Android or iOS devices and used on the go.

Price:

- Free: $0 (First 3 months)

- $29 /mo+ $5 per employee

Pros:

- Simple and easy-to-use interface

- Unlimited pay runs and multiple pay schedules

- Supports multiple earning types and payment options

- Advanced AI-powered virtual assistant guides users through payroll tasks

- Automatic tax filing saves time and money

Cons:

- Limited customization options

- Only available in certain countries

- It Requires internet access for use.

- It may have some of the features needed for larger businesses.

Best for:

Small businesses want to streamline their payroll process and save time and money on tax preparation.

User Review:

I like the Roll app because it is so easy to use. The chat-based interface makes it feel like I’m talking to a real person, and the AI-powered virtual assistant is beneficial. I don’t have to worry about filing taxes manually because the app takes care of everything automatically, which is a huge time-saver.

ADP

ADP is an online payroll software that automates payroll tasks and ensures employees are paid promptly and correctly. ADP stands out in its ability to scale with businesses, from the smallest to the largest. It offers custom-built plans to give enterprises everything they need, specifically allowing them to grow with its tools relevant to their business.

Some of ADP’s key features include employee benefits management, outsourcing tools, talent acquisition tools, and other HR resources. The cloud-based software allows clients and employees to access it from multiple devices. ADP provides custom solutions that fit businesses, whether they strictly need payroll tools or require a full suite of HR services. The ADP Marketplace also helps companies tailor their software with productivity, finance, healthcare, and more apps.

ADP charges a fee per payroll based on the team size, which accommodates mid-to-large teams well, allowing them to choose the plan that fits their payroll. ADP is rich with features and tools, but with more stuff comes more complexities with setup. ADP can offer a dedicated account manager for businesses who can help with setup. However, a dedicated account manager will be an extra cost to the plan.

ADP Payroll solutions automatically monitor and track employee time, pay and calculate taxes, and comply with legal requirements. Plus, employees can log into their accounts within the system to view their hours, pay stubs, taxes paid, and more. ADP provides detailed reports that can assist recruiters in fine-tuning their talent acquisition strategies and help HR departments discover quality issues in benefits and turnover rates.

Why do we like it?

- Scalable payroll platform: ADP’s Run can be customized to match the needs of businesses of all sizes, from small startups to large corporations.

- Tax compliance: ADP handles all necessary payroll tax filings and payments, ensuring compliance with federal, state, and local tax laws.

- Employee self-service portal: Employees can access their pay stubs, tax forms, and other important information through a secure online portal.

- Direct deposit: ADP offers the option of direct deposit payments to employees, which saves time and eliminates the need for paper checks.

- HR support: ADP’s higher-level plans can include access to HR professionals who can guide on compliance, employee relations, and benefits administration.

- Onboarding tools: ADP’s onboarding feature makes bringing new employees onto your team easier and more efficient.

- Mobile access: ADP’s platform is available on desktop computers and mobile devices so that you can process payroll from anywhere.

- Integration with other systems: ADP can integrate with other business software platforms, such as accounting and time-tracking, to streamline payroll administration.

- Reporting and analytics: ADP’s reporting tools help you track payroll costs, analyze trends and make informed decisions based on your data.

Price:

- Essential: $7 /month plus $4/employee /month.

- Enhanced: Pricing available through sales rep.

- Complete: Pricing available through sales rep.

- HR Pro: Pricing available through sales rep.

- Add-on features: Pricing available through sales rep.

Pros:

- Scalable platform suitable for businesses of all sizes

- Advanced features like HR support and employee training are available

- Automatic calculation of paychecks reduces the likelihood of errors

- Multiple ways to run payroll (desktop, mobile, phone)

- Employee self-service portal available

- Direct deposit payments are available

- Option to post job openings on ZipRecruiter

- Customizable pricing for businesses with fewer than 50 employees.

Cons:

- Onboarding customized for each department

- Expensive plans

- Setting up the platform initially can be time-consuming

Best for:

ADP’s Run is best for businesses of all sizes, particularly those with complex payroll needs. It is also a good choice for businesses that require additional HR support, employee training, and job posting services.

User Review:

“I’ve used ADP’s Run payroll for over a year now. It has been a lifesaver! Previously, I had done all of our payrolls manually – which was a huge pain and time-consuming. ADP’s software makes it super easy to do payroll – it automatically calculates everything based on our hours worked and time off. And their customer service is excellent. Highly recommend it!

Expert market

ExpertMarket is a top-of-the-line payroll service designed specifically for small businesses. It offers a comprehensive suite of features that make managing your payroll simple, efficient, and hassle-free. One of the key benefits of ExpertMarket is its affordability. Small businesses can access various payroll services with a low monthly fee, including employee payments, tax filings, and reporting.

This makes it a great option for small businesses with only a few payroll-related tasks and who want to save money on payroll management.. It also offers a user-friendly platform that’s easy to navigate and use. You can easily add or remove employees, set up automatic payments, track hours, and monitor sick leave or vacation time. The software also handles all tax calculations and filings, a huge time saver for small business owners.

Another advantage of ExpertMarket is its ability to integrate with other software programs. You can easily sync your payroll data with accounting software, HR management tools, or time-tracking systems, which makes it easy to manage all aspects of your business from one platform. It also offers additional services to help small companies to streamline their operations.

It includes access to HR support, employee benefits, and even retirement savings plans. These additional features can be incredibly valuable for small businesses that want to provide their employees comprehensive benefits without the added expense and administrative burden. Overall, ExpertMarket is an excellent choice for small businesses seeking an affordable, easy-to-use payroll service offering various features and benefits.

Why do we like it?

- Automated payroll: ExpertMarket automated payroll processing, which helps to save time and reduce errors. The platform automatically calculates taxes, tax deductions, and other payroll-related tasks.

- Direct deposit: ExpertMarket offers direct deposit, which makes it easy to pay employees quickly and efficiently. This feature eliminates the need for paper checks and reduces the risk of errors associated with manual payments.

- Tax filing and compliance: ExpertMarket handles all tax filings and compliance requirements, including federal, state, and local taxes. This ensures that small businesses comply with all regulations and avoid costly penalties.

- Employee self-service: ExpertMarket offers an employee self-service portal, which allows employees to view their pay stubs, tax documents, and other payroll-related information. This feature helps to reduce administrative tasks for the HR team.

- Mobile app: ExpertMarket offers a mobile app that allows small business owners and employees to access payroll information from anywhere. This feature makes it easy to manage payroll on the go and stay updated with critical payroll-related tasks.

- HR support: ExpertMarket offers support to help small businesses manage employee-related tasks such as onboarding, benefits administration, and compliance. This feature helps reduce the administrative burden on small business owners and ensures they comply with all HR-related regulations.

Price:

A typical payroll service costs between $20 and $149, plus employee fees ranging from $4 to $12.

Pros:

- Affordable pricing for small businesses

- The comprehensive suite of features for managing payroll

- User-friendly platform that is easy to use

- Takes care of all tax calculations and filings

- Ability to integrate with other software programs

- Saves time for small business owners by automating payroll tasks

- Customer support is available

Cons:

- It might not be suitable for large or complex businesses

- Limited customization options for payroll and tax settings

- Customer support may be limited

Best for:

Small businesses on a budget need a reliable and easy-to-use basic payroll function.

User Review:

ExpertMarket has been a lifesaver for our small business. We used to spend hours figuring out how to do our payroll, but ExpertMarket makes it so easy. The software is user-friendly, easy to use, and the customer service is also great. We highly recommend ExpertMarket for any small business looking for an affordable, easy-to-use payroll solution.

Paycor

The Paycor payroll software is designed especially for small to midsize businesses with less than ten employees. The Paycor payroll system has various features, such as direct deposit, employee self-service, and contractors who can be paid directly. It offers comprehensive tax reporting and remittance for iOS and Android devices and a mobile app for iOS and Android.

Paycor’s top two plans offer HR resources, while the most expensive plan offers onboarding features. Easy-to-use navigation and Paycor’s complete initial system configuration make it easy to start. Pay grids are used to enter payroll data quickly, and direct deposit, pay cards, or checks are all options for paying your employees.

Paycor offers bundles for small businesses (one to 39 employees) and mid-sized businesses (40+ employees). Paycor will need to quote you if you have more than ten employees. The software also provides add-on module options such as Employee Scheduling, Benefits Management, Time and Labor Management, and Recruiting & Applicant Tracking.

Why do we like it?

- Comprehensive HR management: Paycor covers people management, from recruiting and onboarding to career development and retention.

- HR management: From recruiting and onboarding to performance management and training, Paycor has tools to streamline HR processes.

- Advanced time tracking: Several methods are supported, including biometric readers, badge terminals, web browser time clocks, and mobile punching.

- Employee self-service: Employees can view their schedules, request time off, and access pay stubs and other relevant information from their smartphones or web browsers.

- Compliance management: Paycor’s software helps businesses manage tax calculations and filing, 401 (k) data, workers’ compensation, and other compliance-related tasks.

- Analytics and reporting: Users can access robust analytics and reporting features to gain insights into metrics such as labor costs and employee turnover.

- Mobile-first design: Paycor’s mobile-friendly platform allows employees and managers to access their information anytime.

- Integrations: Paycor integrates with many popular HR and business tools like Slack and Zapier to streamline processes and improve efficiency.

Price:

- Basic: $99 per month, plus $5 /employee /month.

- Essential: $149 per month, plus $7 /employee /month.

- Core: $199 per month, plus $8 /employee /month.

- Complete: $199 per month, plus $14 /employee /month.

Pros:

- Comprehensive HR management platform

- Support for various time-tracking methods

- Vacation and sick leave balance management tools

- Tools for managing tax calculations and filing

- Expense reporting and electronic child support payments are available

- Robust analytics and mobile-first functionality

Cons:

- It may be expensive for smaller businesses

- The majority of plans have setup fees

- Time tracking add-on is available only

Best for:

Small to medium-sized businesses looking for a comprehensive HR and payroll software solution with time tracking, tax management, and analytics capabilities.

User Review:

I’ve been using Paycor for a while now and love it! It’s so comprehensive and covers every aspect of people management. The scheduling tool is beneficial, and the mobile app is excellent for employees who want to view their schedules and request time off. The analytics are robust too, and I can see how my company is doing in real-time.

FAQ’s

What is a small business payroll service?

A payroll service is a software or company that helps businesses manage their payroll tasks, such as calculating employee wages and salaries, deducting taxes and other withholdings, generating paychecks, and handling tax filings and payments. Payroll services can offer additional features like direct deposit, tracking time and attendance, and benefits administration. By outsourcing payroll tasks to service providers, businesses can save time and reduce the risk of errors and compliance issues.

What are the advantages of using a small business payroll service?

Using a small business payroll service can save business owners time, reduce errors in basic payroll processing, ensure compliance with tax laws, and provide access to additional HR tools and services such as benefits management and time tracking.

How do I choose the best small business payroll service?

To choose the best small business payroll service, consider factors such as the size of your business, your budget, features, and the level of support you require. It’s also important to research and compare multiple payroll providers to find the one that best meets your needs.

Can I integrate a small business payroll service with my accounting software?

Most online payroll services for small businesses integrate with popular accounting software such as QuickBooks and Gusto. It’s important to check with the provider to ensure their software is compatible with your accounting software.

Can small businesses afford a payroll service company?

The payroll services offered by small companies generally scale up as your company grows. Typically, they offer payroll services at an introductory price, followed by a per-employee rate.

Conclusion

In conclusion, choosing the best small business payroll service is essential for ensuring your employees are paid accurately and on time while reducing your administrative burden. Many payroll services are available in the market, each with unique features and pricing structures. Some top options include Gusto, ADP, Paychex, Square Payroll, QuickBooks Payroll, and ExpertMarket Payroll.

When selecting a payroll service, it’s important to consider factors such as the size of your business, your budget, your specific payroll needs, and the level of customer support the service provides. By researching and evaluating the options available, you can find the best payroll service that meets the needs of your small business.

Overall, investing in a reliable and efficient payroll service can save you time, money, and the headaches of managing payroll on your own. With the right payroll service, you can streamline your payroll process and ensure that your employees are paid accurately and on time while allowing you to focus on growing your business.

Aaron is an educational specialist focusing on jobs that can be performed outside of the standard office and anywhere in the world. Aaron has worked in the Real Estate industry most of his adult life in both commercial and residential. Financial Nomads was created to bring forward the best online educational courses and software reviews to help people live better lives. https://financialnomads.com

More software reviews you might enjoy

http://financialnomads.com/best-hr-outsourcing-companies/